For a PDF of this report, click here.

Introduction

Many Washingtonians feel they are heavily taxed. They are – if they’re working class or middle class. Wealthy residents pay a tax rate many times lower than the rates other people pay. But due to our opaque tax system, it’s hard to understand how much we pay in taxes, or how much other people pay.

This report compares the tax obligations of households at the $25,000, $50,000, $75,000, $100,000, $150,000 and $250,000 income levels in Bellevue, Bellingham, Everett, Federal Way, Kent, Olympia, Pasco, Pullman, Renton, Seattle, Spokane, Tacoma, Vancouver, Wenatchee and Yakima. In Seattle, the combination of state and local taxes results in a system which relies much more heavily on taxes on the people least able to pay, while not imposing significantly higher taxes on the wealthy.

This report also compares job growth in states and cities with their income tax structures and effective tax rates on wealthy households. In neither case is there any correlation.

In a system of taxation based on justice and equity it is fundamental that the burdens be proportioned to the capacity of the people contributing.

– Pope John XXIII, May 15, 1961[1]

1) Executive Summary

As Seattle grows and changes, it faces an increasing number of crises – a lack of affordable housing, people without shelter dying on our streets, families struggling to pay for child care and college, environmental challenges, and streets clogged with traffic. As residents, we want a city where everyone can flourish with world-class schools, diverse neighborhoods, and reliable public transportation.

We could achieve a more prosperous future, with early learning for all our children, tuition-free community college, affordable communities, and green-energy initiatives. But you can’t get something for nothing.

If we want major improvements and to maintain the economic and cultural diversity that give Seattle so much vibrancy, we need new progressive sources of public revenue to invest in our future.

Over the past 10 years, Seattle has moved in the opposite direction. Well-educated Seattle residents are becoming wealthier, but everyone else is not. The ability of city government to pay for the public services to keep the city running has become strained. Adjusted for inflation, general fund expenditures have grown from $1.1 billion in 2008 to $1.3 billion in 2018. But Seattle’s population has grown as well, from 592,000 to 738,000 people. Seattle is actually spending about $110 less per resident now than it did in 2008, at the start of the Great Recession.

Seattle is trapped by Washington’s regressive tax structure. Like other cities, counties, and school districts in the state, Seattle turns repeatedly to the tools at hand – property, sales and automobile taxes – to pay for police, fire fighting, libraries, preschool, health clinics, and transit. This makes it impossible for cities to raise new revenue without increasing the already exceptionally high percentages of their incomes that lower-income and middle-class residents pay in state and local taxes.

Wealthier residents, on the other hand, pay a uniquely low tax rate compared to other major cities in the country.

As the state’s largest city and the heart of the regional economy, Seattle has unique needs for public services. As regressive taxes pile up, they compound the city’s affordability crisis – driving people out of the city or into homelessness.

Multiple studies using a variety of methodologies have documented that Washington’s mix of state and local taxes results in the wealthy paying too little and low-income and working-class households paying too much:

- In 2014, the Washington Department of Revenue estimated that a household making $15,000 per year pays 26.5 percent of its income in state and local taxes, while a household making $140,000 pays 5.9 percent.

- In 2015, researchers from the Federal Reserve found that the Washington State tax system undoes 13 percent of the income inequality mitigation caused by federal taxes, the tenth highest rate in the nation.

- In 2015, the Institute on Taxation and Economic Policy confirmed that Washington State’s tax system is the most regressive in the country, estimating that a household making $21,000 per year pays 16.8 percent of its income in state and local taxes, while a household making $507,000 pays 2.4 percent.

- In 2017, the Office of the Chief Financial Officer of the District of Columbia found Seattle’s tax system to be the most regressive of the largest cities in every state, estimating that a household making $25,000 per year pays 14.0 percent of its income in state and local taxes, while a household making $150,000 pays 5.7 percent.

This report, using more localized data than the DC study, found Seattle’s tax system to be the most regressive of major cities in Washington, estimating that a household making $25,000 per year pays 17.0 percent of its income in state and local taxes, while a household making $250,000 pays 4.4 percent.

The majority of taxes paid by residents of Washington go to the state. Seattle and other cities raise revenue using the same tax tools, compounding the regressivity of the state tax structure. Even if public expenditures are relatively progressive in nature, city projects are increasingly being built on the backs of those who can least afford to pay for them.

Washington cities lose millions of dollars every year by enacting taxes that mimic the state’s tax breaks on the wealthy.

Seattle likes to think of itself as a progressive beacon in the state. But in a beauty pageant among regressive tax structures, it’s actually Spokane that comes out on top.

Table 1

There are some regional trends. Seattle and Bellevue consistently jockey for the highest tax rates at any household income level. Cities in King County tend to have higher tax rates than other cities in Western Washington, driven largely by voter-approved property and sales tax levies for schools, transit, low-income housing, and other services. Tax rates in Eastern Washington cities overall reflect fewer of these urban services.

Households making $25,000 pay an extra 7.3 percent of their incomes if they live in Seattle rather than Yakima, while households making $250,000 only pay 1.9 percent more.

Increasing income inequality has pushed this regressive tax structure to a breaking point. Skyrocketing costs for basic necessities mean more people are turning to public services, but low-income and middle-class residents simply can’t afford to pay more in taxes. However, the rich can and should. The gap between the poorest and richest quintiles statewide went from $152,631 in 2010 to $192,146 in 2016, adjusted for inflation. In Seattle, it grew from $193,738 to $256,249. The income gap between the top and bottom quintiles is more than 25 percent greater in Seattle than it is statewide.

Opponents to progressive taxation say that giving the rich bigger tax breaks than working-class and middle-class people encourages job growth. Statistical analysis shows that this isn’t true. Linear regression models show that state tax systems with no personal income taxes or light personal income taxes cannot explain at least 96 percent of state job growth since 2006.

When comparing the largest cities in each state, tax systems that lightly tax the rich cannot explain at least 99 percent of growth.

There is very little, if any, connection between low taxes on the wealthy and a region’s ability to generate jobs. Such a claim is simply a localized version of Reagan-style trickle-down economic rhetoric. Moreover, public policy should support economic development that benefits the whole community, not blindly seek new jobs to be filled exclusively by newcomers who drive out once vibrant communities.

When you break down the differences in taxation into calendar days, households making $250,000 received enough income in 2016 to pay state and local taxes within the first three weeks of January, no matter where they lived. But it took at least five weeks for a household earning $25,000. In Seattle, it took almost 9 weeks for a low-income household, meaning they worked into March just to pay state and local taxes.

New and increased taxes in the last few years have only increased the disparity in Seattle. The increased Seattle sales taxes, Washington State’s revised property tax system, the higher transportation benefit district taxes, and even the new soda tax are all regressive in nature. Using the most recent income data from 2016, a household making $25,000 now has to work four more days in Seattle, until March 7, to meet state and local tax obligations.

Reliance on sales taxes means public revenues will continue the long term trend of growing more slowly than the economy overall unless tax rates are continually increased. In fiscal year 1979, taxable sales accounted for 59.3 percent of the state’s per capita income. By 2016, that shrank to 36.3 percent as the economy shifted increasingly from goods to services. In the past six recessionary periods, taxable sales took on average 2.3 times longer to recover than income in Washington.

While every city has needs, Seattle faces an unprecedented amount of exigent issues – rapidly increasing housing costs, the fourth worst traffic congestion in the country, communities being devastated by gentrification, and elderly people on the verge of homelessness. While median income in the city is increasing for residents with bachelor’s and graduate degrees, it’s on a downward trend for high school graduates and those with associate’s degrees.

Seattleites have repeatedly shown that they want a progressive income tax, even if other parts of the state aren’t ready for it. In 2010, Seattle approved Initiative 1098 with 63 percent of the vote. In 2017, a KING-TV poll found that number still stayed strong, with 69 percent approving of the new 2.25 percent tax on income over $250,000 for individuals or $500,000 for joint filers, which in turn would lower regressive sales and property taxes.

We all want a Seattle where everyone can live and thrive. But Seattle needs more public revenue to build affordable housing, provide services for the homeless population, improve transit, increase access to affordable childcare, and fund tuition-free community college. Increasing regressive taxes already in place simply increases the burden on low-income residents to fund services that ultimately benefit everybody, while excusing the affluent from contributing proportionally to build the commonwealth of the city.

The Washington Supreme Court decided in 2017 that cities have a right to manage their own affairs when it determined that Seattle’s tax on guns and ammunition is authorized under Revised Code of Washington 35.22.280(32), which grants first class cities broad tax powers.

Eighty years ago, the Supreme Court narrowly ruled that income taxes are allowed only if they are not progressive. We no longer have the economy of the 1930s, and the precedents that the Court relied on have all been overturned.

It’s time to let citizens decide what’s best for themselves. If Seattle wants a tax system that is more equitable and is less rigged in favor of the very wealthy, it’s time to let them make that choice.

2) A Problem that Starts with the State

People who are wealthier tended to get dramatically more benefits than the middle class or those who are poor, and so [regressive taxation] runs counter to the general trend you’d like to see, where the safety net is getting stronger and those at the top are paying higher taxes. I need to pay higher taxes. I’ve paid more taxes, over $10 billion, than anyone else, but the government should require the people in my position to pay significantly higher taxes.

– Bill Gates, founder of Microsoft, February 2, 2018[2]

Washington taxes working- and middle-class households at astonishingly higher rates than the wealthy because of its ubiquitously regressive system.

2.1) A System Based on Regressive Taxes

In a regressive tax system, low-income households contribute a larger percentage of their income in taxes than high-income households. Regressive taxes contrast with a flat tax, by which households in different income brackets contribute the same proportion of their income, and a progressive tax, by which tax rates are higher on the wealthy than on those who can least afford to pay.

Washington State’s tax system is made up almost entirely of regressive taxes, with the exception of our progressive estate tax.[3] The estate tax, however, is a comparatively small source of revenue. In fiscal year 2016, estate taxes provided $135 million to the state – 0.7 percent of the state’s general fund revenue from taxes.[4]

The federal income tax is one of the farthest-reaching progressive taxes. For single filers who submitted taxes in 2018, everyone paid 10 percent on the first $9,325 of taxable income, 15 percent on the next income up to $37,950, and so on up to 39.6 percent on income over $418,400.[5] With a standard exemption, someone earning $22,000 would pay 1 percent of their income in federal income taxes, whereas someone making $80,000 would pay 15.3 percent. (Although for taxes paid in 2019, it will be less progressive when President Donald Trump’s tax cuts come into effect.[6])

A true flat tax is rare. Only eight states have flat income taxes, with rates ranging from 3.07 percent in Pennsylvania to 5.499 percent in North Carolina.[7] Income taxes in other states are progressive, with the rich paying proportionally more than middle-class and low-income workers.

People often mistake taxes on goods for flat taxes. For instance, gas in Washington State is sold with a $0.494 state tax on every gallon, no matter who you are. This is actually a regressive tax, because in practice it takes up a higher share of income for low-income or middle-class people than for high-income people. In addition, rich people are increasingly more likely to buy electric cars and not pay the gas tax at all.[8] For the gas tax to be a flat tax, someone making $250,000 per year would have to buy 10 times as much gas as someone making $25,000. The Bureau of Labor Statistics’ Consumer Expenditure Surveys have consistently shown that to be false. Data from 2016 show that a household making about $25,000 spends on average $1,300 on gasoline, while a household making about $250,000 spends on average $2,900 – just over twice as much.[9]

Whether it be gas, food, clothing, cleaning supplies or entertainment, purchase of goods does not scale proportionally with income. To that effect, when the IRS calculates estimated sales tax expenditures for deductions on the federal income tax, it estimates that a household making $250,000 spends a little over three times as much in sales tax as a household earning $25,000.[10] The lack of proportional scaling makes taxes on goods inherently regressive.

Every major statewide tax in Washington is regressive. Gas taxes, sales taxes, alcohol taxes, tobacco taxes, property taxes, utility taxes and health insurance premium taxes – all of these taxes hit the pocketbooks of low-income Washingtonians harder than those of the wealthy.

The Business and Occupation Tax is more complicated. As a gross-receipts tax, it functions similarly to a sales tax, with part of it passed on directly to consumers. Because the B&O tax falls on all stages of production, proportionally less of the tax falls on in-state consumers. The B&O tax is also applied broadly, so its ultimate distributional impact is different from that of general sales taxes, although some economists treat it as a sales tax.

While it may be less regressive than other taxes in Washington, researchers have still found it to be regressive in its impact on individuals and households.[11] The B&O tax is also regressive for businesses – firms with less than $5 million in total annual income pay a greater percentage towards B&O and other taxes than companies with more than $25 million.[12]

Some economists even argue that the state lottery is a form of regressive taxation.[13] In fiscal year 2017, Washington State spent $14.9 million on promotion and advertising to encourage people to give money to the “Department of Imagination.” For every dollar taken in from lottery sales, the state spent $0.24 for state services, mainly for education, but also building stadiums and fighting gambling addiction. The rest of the money mainly went to administration and prize payouts.[14]

2.2) How Unfair is Washington State?

If you have free trade and free circulation of capital and people but destroy the social state and all forms of progressive taxation, the temptations of defensive nationalism and identity politics will very likely grow stronger than ever in both Europe and the United States.

– Economist Thomas Piketty, 2017.[15]

The United States has been in a time of rapidly increasing income inequality since 1980. A 2016 report from the Economic Policy Institute showed that all of the new income generated in Washington between 2009 and 2013 was captured by the top 1 percent.[16] The bottom 99 percent actually saw their incomes decrease by 1.8 percent.

After the Second World War, Washington saw a record high level of income equality – the bottom 90 percent of the population captured 79 percent of the income in 1945, as shown in Figure 1. Through 1979, the bottom 90 retained about 70 percent of income, but the rate has declined steadily since, with the rate of decline accelerating during economic booms and modest rebounding during recessions. By 2012, the bottom 90 percent of households only received 50 percent of total state income. The other 50 percent went to the top 10 percent of households. The top 1 percent received over 20 percent of all state income in 2012, almost tripling their share since 1979.

Figure 1

Since 2013, real incomes have gone up for many Washingtonians, but the wealthy continue to capture an ever greater share of income in Washington, as shown in Figure 2. From 2010 to 2016, the mean income for the bottom 20 percent of the population increased 11 percent – but the top 20 percent gained 19.9 percent. The annual gap between the poorest and richest quintiles grew from $152,631 to $192,146.[17]

Figure 2

After Washingtonians are done paying their state and local taxes, the gap between rich and poor becomes even greater. That’s because in Washington State, we have one of the most regressive tax structures in the country – if not the most regressive.

Using 30 years of data from the Current Population Survey,[18] researchers from the Federal Reserve compared before-tax and after-tax income inequality among each of the 50 states and the District of Columbia in a 2015 report.[19] They found that while federal income taxes mitigate income inequality, state tax systems tend to increase it. According this study, our Washington’s tax system undoes 13 percent of the income inequality mitigation caused by federal taxes, the tenth highest impact in the nation.

According to this study, the gas tax is the most influential in increasing income inequality. For years, Washington has had the second-highest gas tax in the nation, behind only Pennsylvania.[20]

The Federal Reserve study measured the difference in incomes for non-elderly people in the 10th and 90th income percentiles, and only for statewide taxes. A separate 2015 study by the Institute for Taxation and Economic Policy analyzed combined state and local taxes and broke the categories down even farther, running simulations for seven income categories.

ITEP found that Washington has the most unfair tax system for poor and middle-class taxpayers, as shown in Figure 3. In real dollars, ITEP estimated that a typical Washington household making $21,000 per year paid $3,528 in state and local taxes in 2014 (16.8 percent), but a household making $210,000 paid $9,660 (4.6 percent). The second household made 10 times as much, but contributed proportionally three times less in taxes.[21]

Across all 50 states, ITEP found the top 1 percent of households paid an average of 5.4 percent in state and local taxes – more than double the 2.4 percent Washington’s tax system required.[22]

Figure 3

In a 2014 report, the Washington State Department of Revenue released a model allowing a user to create hypothetical tax situations for places in Washington.[23] In it, they created estimates using the taxes in place at the time, resulting in the exposure of tax disparities even starker than under ITEP’s model, as shown in Figure 4, perhaps because the cutoff for the lowest income bracket was $15,000 instead of $21,000.

Figure 4

Almost everything about the Washington State system is regressive. It doesn’t have a personal income tax. It taxes businesses through a gross receipts tax in lieu of a corporate profits tax. It has a very high reliance on sales taxes and higher rates compared to the majority of states. Washington has relatively high taxes on gasoline, cigarettes and alcohol.[24] For property taxes, Washington doesn’t offer a “circuit breaker” system to reduce the taxes of low-income taxpayers unless they are elderly or disabled.

Perhaps the only positive note is that Washington doesn’t tax most food from the grocery store. (Washington has also enacted the Working Families Tax Rebate, but the Legislature has failed to fund it for a decade.)[25]

Our regressive tax system reinforces the polarization of income, in a vicious cycle which places high taxes on middle- and low-income households, while under-taxing the most affluent. This encourages the migration of income to the elite.

It’s hard for most Washingtonians to know this. Reliance on sales and excise taxes means that people don’t really know how much they are paying in taxes – or how much other people are. Seattle economist Dick Conway measured the transparency of every state tax system in 2017, based on US Census data. Oregon, which has an income tax and no sales tax, is the most transparent. Washington has one of the least transparent, ahead of only Nevada.[26]

2.3 Washington’s Tax System is Ripe for Failure

For the entirety of the 21st century, Washington State has had a comparatively low effective tax rate – the total percent of income allocated to taxes. In fiscal year 1995, Washington had an effective rate of 11.4 percent, according to Conway.[27] In fiscal year 2015, it was 9.3 percent. Without intervention, he estimates that the effective state and local tax rate in Washington will fall to 8.5 percent in fiscal year 2025.

On average, Washingtonians are paying less and less of their income in state taxes – but not all Washingtonians, because taxes are low for the wealthy, but high for the poor.

Washingtonians on the whole are getting richer. As shown in Figure 2, every quintile gained income from 2010 to 2016, even though the rich had much bigger gains.

Because Washington taxes people with higher incomes at lower rates, the effective tax rate falls when average income increases. A lower effective tax rate does not mean that people in lower income brackets are paying less in taxes. It’s like raising the roof on a house – the ceiling may go up, but that doesn’t mean the floor is coming with it.

The mean inflation-adjusted income for the bottom 90 percent of Washingtonians remained almost unchanged between 1969 ($36,238) and 2013 ($36,112). For the top 10 percent, however, mean income almost doubled, from $152,101 to $283,702, as shown in Figure 5.[28]

Figure 5

Growing income inequality compounds the negative impact of our regressive tax system on public revenues. In the 1970s, Washington State had a more robust middle class with less extremes of wealth and poverty, as shown in Figure 1. The distribution of income, even with a regressive tax structure, generated the public revenue for building and maintaining public goods and services for all Washingtonians.

Washington State’s sales tax is the largest revenue generator, accounting for 47.9 percent of the state’s general fund revenue in fiscal year 2017.[29] But over time, that revenue stream is declining as the economy shifts from goods to services.

Through the middle part of the 20th century, when our economy was based largely on the consumption of goods, sales tax revenues largely kept up with personal income growth. But our economy has shifted from the consumption of things to the consumption of services for decades.[30]

While the state taxes construction labor, repair services, and some other services, the retail sales tax does not apply to the majority of services.[31] As Washington gets richer, taxable sales have remained relatively flat, as shown in Figure 6. In fact, in fiscal year 2016, per capita income in Washington was two and half times greater than in fiscal year 1969, but taxable sales were only one and a half times greater.

Figure 6

The increase in online sales is also putting pressure on retail sales tax revenue. Currently, only online retailers that have a physical presence in Washington – Amazon does, eBay doesn’t – have to collect sales taxes on sales to Washington residents. In 1998, online commerce accounted for about 0.3 percent of commonly taxable retail trade nationwide. By 2013, online commerce accounted for almost 13 percent.[32] Washington is trying to stem the tide of decreasing sales tax revenue by forcing online retailers to collect sales tax.[33]

Lower-income people use the internet much less than higher-income people, making them less likely to benefit from tax-free online sales. In 2018, 98 percent of adults in households with a yearly income of more than $75,000 use the internet, compared with 81 percent of adults from households with less than $30,000 in yearly income.[34]

Reliance on sales tax also means that the Washington State budget takes longer to recover from recessions, as shown in Figure 7.

Figure 7

Income taxes have been historically more volatile – as income decreases during a recession, so do income tax revenues. On the other hand, people still buy basic consumer goods during a recession, even though they buy less. They take longer to recover, but they dip to a shallower trough. This has tended to make sales taxes more stable and reliable.

But after the Great Recession, that may no longer be the case. The Urban Institute found that the housing crisis of 2008 caused construction and sales of home furnishings and appliances to drop significantly, hitting sales-tax-reliant states unprecedentedly hard.[35]

As many states have had difficulty recovering tax revenues since the Great Recession, more have increasingly shifted from reliance on income taxes to sales taxes, seeking the latter’s historical reliability. But because revenue from sales taxes is eroding, the Urban Institute predicts sales-tax-reliant states will face anemic revenue growth compared with states that incorporate income taxes into their tax structures.[36]

According to a study from the Pew Charitable Trusts, Washington took longer to recover tax revenue after the Great Recession than other states.[37] While the average state had a pre-recession peak in revenue in the third quarter of 2008 and recovered in the second quarter of 2013, Washington had a peak in the first quarter of 2008 and recovered in the first quarter of 2015.

Washington takes so long to recover because it relies so heavily on sales taxes. In the past six recessionary periods, taxable sales took on average 2.3 times longer to recover than income in Washington. This also reflects the influences of the shift from sales of goods to services and the movement of sales from brick-and-mortar stores to online.

It’s this lagging that points to the vulnerability of sales taxes long-term. While sales taxes erode, income taxes do not. Long-term, sales taxes provide anemic revenue growth compared to income taxes. Sales tax expansions are also extremely unpopular at the polls. For the past few decades, state attempts across the country at expanding the sales tax base to cover more goods and services have failed or been pared down significantly.[38]

These are the factors that Conway highlighted in rating Washington’s tax system the 42nd most unstable.[39]

2.4) Job Growth Is Not Determined by State Tax Systems

Conservative organizations such as the Heritage Foundation and the Tax Foundation often oppose progressive income taxes, claiming they harm job growth. In its yearly reports, the Tax Foundation ranks the state tax systems that in their view create the best business tax climate.[40] For 2016, their top five were Wyoming, South Dakota, Alaska, Florida and Nevada – five of the nine states with no personal income tax. The bottom five states were among those with the highest income taxes. Washington placed 17th.

The Tax Foundation follows the narrative of opponents of progressive tax reform – Washington’s lack of personal income taxes purportedly helps recruitment and makes Washington competitive, with former Microsoft CEO Steve Ballmer saying it’s a major advantage for our state over California.[41]

But as shown by Conway, statistical analysis shows that states without personal income taxes do not have better job growth than states with them.[42] Figure 8 uses Conway’s methods, showing no relation (R2 of 0.001) between real job growth and the presence of a personal income tax, when filtered through the Tax Foundation’s 2016 Business Tax Climate Index.[43]

Figure 8

Comparing full- and part-time wage and salary job growth from 1970 to 2016, some large-population states like California (rank 48), Texas (13) and Florida (4) experienced a lot of the job growth, as one would expect, but they find themselves at either sides of the ranking. Other large states like Michigan (rank 12), New York (49) and Pennsylvania (26) experienced very little of the job growth relative to their size and are also spread throughout the ranking. Of the smallest states, there is virtually no difference in real job growth between North Dakota (rank 30) and South Dakota (2).

But that is just one method of analysis, and using real job growth may benefit states like California, Texas and Florida because they have the largest populations, even though other large states are not outliers. Plus, extending the chart all the way back to 1970 may provide too large a time period for effective comparison in current circumstances.

Figure 9 compares relative job growth in each state from the most recent decade of data available – 2006 to 2016 – and the Tax Foundation 2016 ranking.

Figure 9

At first blush, there is indeed a slight correlation between the Tax Foundation’s 2016 ranking and a state’s job growth (R2 of 0.036). But the low coefficient of determination means that the Business Tax Climate Index can only explain at most 4 percent of state job growth differences, with 96 percent from other reasons.

To wit: Sparsely populated North Dakota is an outlier for high job growth, even though it’s unfavorably ranked. North Dakota is experiencing an oil boom.[44] Texas is up there due to primarily mining and manufacturing.[45] The Utah Chamber of Commerce attributed the state’s success to investment in K-12 education programs.[46] West Virginia’s at the bottom, as coal mines shut down, with some parts of the state losing as many as 70 percent of their coal-mining jobs.[47]

Comparing states with no personal income taxes and states with high personal income taxes in a box-and-whisker plot, as shown in Figure 10, the edge of income-tax-free states appears to be a collection of individual cases rather than a trend.

Figure 10

Americans have also been moving west for centuries and south since the widespread adoption of air conditioning in the 1970s.[48] Coincidentally, these states are clustered in high ranks of the Tax Foundation list.

Some people have indeed moved for jobs. But much of it is due to other circumstances. In a 2014 report, the US Census Bureau found that of all people who moved 500 miles or more in 2012 and 2013, fewer than half (48.0 percent) said they moved for employment (including retirement), while more than half said they moved for housing, family or other reasons.[49]

One of the biggest factors affecting migration to the Sun Belt since 2000 is the retirement of the Baby Boomers. Not only are they leaving the workforce, they’re also leaving cities. In addition to the attraction of warmer and sunnier climates, that migration could also be partly attributed to the lack of affordable housing in walkable neighborhoods in northern cities that allow seniors to age in place.[50] Elder caregiving is one of the fastest-growing careers in the United States, and the jobs may be following them.[51]

This quickly becomes a chicken-and-egg situation. Are people moving to south and west because there are jobs there, or are there jobs there because people are moving and creating them?

If anything, there’s a stronger correlation between regions and job growth, as shown in Figure 11.

Figure 11

If people are moving to Washington for jobs, not all are finding them. In terms of raw numbers, Washington’s employment rate ranked 31st in the nation in 2017, below the national average of 78.6 percent.[52]

2.5) Higher Pressure on Revenue Sources in the Future

The combination of legislative inaction and rapid economic change have created a tax system that has not kept up with the times. And as a result: we – as a state – are not able to accomplish the things that we were able to do just a generation ago.

– King County Executive Dow Constantine, February 2, 2018[53]

Falling state revenues relative to population and economic growth have meant Washington State cannot keep up with the services offered residents in the past, or plan for the pressures of the future.

Higher education spending has plummeted in the past two decades, causing tuition to double at Washington state public universities, colleges and community colleges – after accounting for inflation, as shown in Figure 12. About 16,500 qualifying lower income college students have been excluded from the state need grant.[54]

Figure 12

Our state has underfunded mental health care and recovery, lowering access to care, increasing the prevalence of mental illness, and contributing to the homelessness crisis.[55] In order to preserve money for higher-priority services, the Legislature has also defunded state parks and privatized park services.[56]

The pressures on state revenues will only worsen. The Centers for Medicare and Medicaid Services project that state Medicaid expenditures, jointly financed by federal and state sources, will increase over 6 percent annually over the next decade.[57] Higher Medicaid spending affects more than just federal spending; state Medicaid expenditures have increased from less than 13 percent of general fund budgets in 1993 to 19 percent in 2012. [58]

Despite increasing expenditures on K-12 over the past several years, continuing to improve educational opportunities and outcomes, attract and retain teachers and staff, reduce class sizes and build new class rooms will continue to demand more state resources.[59]

3) Income Gaps and Regressive Taxes Make Seattle More Unequal than Anywhere Else in Washington

We’ve seen about a $635 average rent increase in the last six years, and now more than 4,500 people are living on the streets of King County. They are not strangers, they are not out-of-towners, they are not people who have made poor decisions and suffer the consequences. They are our neighbors that we have pushed from their homes due to progress. It is our duty to make sure that as Seattle becomes richer, it becomes richer for everyone.

– Real Change Organizer Tiffani McCoy, July 10, 2017[60]

3.1) The Seattle Area Has the Highest Income Inequality in the State (Except for the San Juan Islands)

Incomes in Seattle are more polarized than in the state as a whole. When comparing increases in mean income by quintile from 2010 to 2016, Figure 2 shows that income for the bottom quintile of the population of Washington increased 11 percent and for the top quintile 19.9 percent, while Figure 13 shows that in Seattle the lowest gained 18 percent and the highest 24 percent.

Figure 13

Because income is rising at more equal rates across cohorts, it may seem like Seattle is trending towards less income inequality, but it isn’t. The gap between the poorest and richest quintiles statewide went from $152,631 in 2010 to $192,146 in 2016. In Seattle, it grew from $193,738 to $256,249. The resulting income gap between the top and bottom quintiles is more than 25 percent greater in Seattle than in the state.

The bottom quintile in Seattle made slightly less money than the bottom quintile statewide in 2016, as shown in Figure 14. Generally, that could be a negligible difference, but given Seattle’s higher cost of living, that means that for low-income people in Seattle, their income stretches much less far than in other places.

Figure 14

Census data, while giving a general picture of income inequality, are not good for getting into the nitty-gritty of what the very rich are really gaining in income, or how much of the nation’s wealth they have. For confidentiality reasons, the Census Bureau has a system of “topcoding” reported income components to prevent the identification of individuals with extremely high incomes. [61] In effect, any income over $999,997 is registered as just that: $999,997.[62] That’s not a great measure for an annual income in the hundreds of millions of dollars, such as Amazon co-founder Jeff Bezos enjoys.[63] The census data works to find out how many rich people there are, but not how rich they are.

In 2016, the Economic Policy Institute used IRS data to get a more accurate picture of income inequality in every state, metropolitan area and county.[64] Through this data, they could pinpoint the average income of a cohort as small as the top 0.1 percent of the population. According to these data, Washington placed 12th in income inequality among the states.

EPI didn’t break down the data to the city level – this can be very difficult because the IRS data is based on zip code, and many zip codes do not follow city boundaries. But they did break it down by county, which shows the inequality differences throughout the state.

Figure 15

In 2013, San Juan County had the highest gap between the average income of the top 10 percent and the lowest 90 percent: $486,986. King County was a little behind: $385,653. Every other county was between $117,000 and $223,000, as shown in Figure 15.

In San Juan County, the top 10 percent of the population takes 68.4 percent of the income; the top 0.1 percent takes 24.8. But San Juan County is an outlier. It’s one of the least populated counties, with 16,252 people,[65] a large number of vacation homes, affluent retirees, and many service industry workers. King County has 130 times as many people as San Juan County.

In King County, the state’s most populous county with 2.1 million residents, the top 10 percent took 51.2 percent of the income, as shown in Figure 16. Some other counties came close – but not the next most populous counties of Pierce, Snohomish, Spokane or Clark.

Figure 16

The impact on income inequality in King County, with the richest 10 percent taking half the income, creating an income gap of $385,653, is far greater than the impact on income inequality in Whitman County, with the top 10 percent taking half the income, creating an income gap of $157,085.

The main reason for the disparity in share of income is not due to the top 10 percent as a whole – it’s the disparity with the top 0.1 percent that skews it for everyone else. In 2013, the top 0.1 percent were the 6,900 highest-income people in the state making an average of $5.4 million per year,[66] people like Jeff Bezos and Bill Gates who mostly live in King County.[67]

Seattle makes up a third of King County’s population, and that share is rising. Seattle had a record-breaking 3.1 percent population growth in 2016 – the fastest-growing big city in the nation. But King County’s population outside Seattle increased by just 1 percent, its slowest rate of growth since 2004. Seattle has outpaced its suburbs’ growth every year since 2010.[68]

King County also makes up three-tenths of the state’s population, meaning that the Seattle area’s inequality has big ramifications for the state average.[69]

3.2) The Combination of State and Local Taxes in Seattle Create One of the Most Regressive Systems in the Country

Every year since 1997, the District of Columbia Office of the Chief Financial Officer has published a study comparing the tax obligations of residents in Washington, DC and in the largest cities in every state. This office analyzes the state and local sales taxes, income taxes, property taxes and automobile taxes on households earning $25,000, $50,000, $75,000, $100,000 and $150,000 per year. In the study analyzing 2016 taxes, Seattle stood out for its regressive and inequitable tax system.[70]

Seattle ranked 4th highest for taxes on a household with an income of $25,000 (14 percent), and dropped to 47th highest for a household with an income of $150,000 (5.7 percent), as shown in Figure 17. No other city had such a large gap in rankings. In fact, of the cities where there is no personal income tax at either the state or local level, Seattle still taxed the poor more – Memphis follows at rank 13 (11.4 percent), Las Vegas at 24 (10 percent), and every other income-tax-less city is in the bottom half.

Figure 17

The nine cities without a personal income tax filled nine out of ten of the lightest tax ranks at every level over $75,000/year. But only Anchorage and Cheyenne were among the ten lightest on lower income households. Both Alaska and Wyoming are rich in fossil fuels, allowing them to have low taxes. Alaska is even able to pay dividends to residents who live in the state.[71]

Cities where the poorest households paid the lowest taxes functioned progressively because of their state income taxes. Boston, New York, Washington, DC, Denver, Providence, Oklahoma City, Portland, ME, Baltimore, Wichita, Milwaukee, Newark, Bridgeport, Omaha, Boise, Albuquerque, Minneapolis and Burlington all had a negative income tax rate on households earning $25,000 per year, meaning they gave money back to them through an Earned Income Tax Credit.

In fact, Burlington was able to have an income tax rebate of $4,004 for a household at the $25,000 level, for an effective tax rate of -5.7 percent. Yet it still didn’t chart as one of the highest tax cities for the richest households, taxing those at $150,000 per year at rank 16 (11.2 percent).

The study assumes that the family with an annual income of $25,000 does not own a home, but instead rents. Because renters indirectly pay property taxes through their rent, the DC study estimates the percentage of their rent constituting property tax. In a 2017 report, the Lincoln Institute of Land Policy and the Minnesota Center for Fiscal Excellence note that states vary in how they tax rental properties in comparison to owner-occupied housing.[72] New York City taxes rental buildings much more than homes, and some, if not all, of the taxes are passed on to renters. Chicago taxes apartment buildings less than homes. [73]

For cities with lopsided taxes on renters, some states provided tax assistance through circuit-breaker programs. Taxpayers with incomes below a certain level are given some income tax reduction when their imputed property taxes exceed a certain percentage of their income. These are available for low-income renters of all ages in the District of Columbia, Hawaii, Maryland, Michigan, Minnesota, Montana, Vermont and Wisconsin.[74] Many others have additional programs only for the elderly. These rebates are all built into their income tax systems, and so have been unavailable to cities like Seattle.

Washington State does offer property tax deferral for homeowners who are disabled, low-income or senior citizens.[75] The loan and interest must be repaid after the sale of the home or the death of the recipient. The state offers small tax exceptions to low-income senior and disabled homeowners,[76] but only offers monetary assistance for widows and widowers of veterans who own their home.[77] King County also offers a property tax reduction/exemption program, but also for only low-income seniors and disabled homeowners.[78] There are no reductions or exemptions for other low-income people.

Las Vegas, Virginia Beach and Cheyenne have no income tax, yet still provide preferential taxation of rentals (like Chicago does). As some, if not all, of property tax on rental property is passed on to renters, the assumption is that a lower rate will mean lower rents for renters, who tend to be in lower income brackets.[79] Seattle offers no such difference in classification ratio, and no such relief.

3.3) EOI Study: The Combination of State and Local Taxes is More Regressive in Seattle than in Other Washington Cities

The District of Columbia study uses tax rates from the largest cities in each state, but some of these cities are still quite small. Burlington, Charleston, Cheyenne, and Portland, ME each had fewer than 100,000 people in 2016.[80] Cities this small do not enable statistically reliable data in the American Community Survey. In order to use reliable and comparable data, the study used Metropolitan Statistical Areas (MSAs) created by the US Census Bureau in calculating property values and rents.

This skews the data for Seattle a little, as the Seattle-Bellevue-Tacoma MSA includes much of urban and suburban King, Pierce and Snohomish Counties. It’s hard to get a clear picture of Seattle property taxes while also including house values from Everett, Medina, Tacoma, Puyallup and Edmonds.

This EOI research used similar methodology to the District of Columbia report, but took it a step farther. Using city-level data, taxes paid by Seattle residents were compared to residents of 14 other large cities in Washington – four in King County, five in Western Washington outside King County, and five in Eastern Washington. Overall, this covered 30.9 percent of Washington’s population in 2016.[81] This section will gloss over some parts of the methodology, but a full description of it can be found in Section 6.

Instead of using mean house values in each city and extrapolating from there (like the District of Columbia Study does), this report uses the mean house values at each income level, better showing the regressivity of property taxes. Income and property value do not increase at a 1:1 ratio – in 2016, home-owning households in Seattle making $50,000 had a median property value of $350,000, while a household making $250,000 had a median property value of $685,000, as shown in Figure 18. Since the property tax rate itself is constant, this makes property taxes regressive for home-owning households.

Figure 18

All tax obligations were calculated using 2016 data at 2016 tax rates.

The District of Columbia report assumed that households making $50,000 a year or more owned a home. In Seattle, that’s no longer a reality for many households at that income level. This report includes income brackets for households renting their home at $25,000, $50,000 and $75,000 per year income levels. As in the District of Columbia report, this report uses a property tax equivalent of rent of 15 percent, the reasons for which are in Section 6.

This report also includes a home-owning income bracket at $250,000 per year to get a better picture of taxation on the very wealthy.

Unlike the District of Columbia report, tobacco, alcohol, health insurance premium and utility taxes are also included for a more comprehensive picture. When compared to other cities in Washington, the combined state and local tax system in Seattle is by far the most regressive, as shown in Figure 19.

Figure 19

Seattle had the biggest gap in the tax rate on high- and low-income households of any of the cities – a household making $25,000 pays 17.0 percent, but a household making $250,000 pays 4.4 percent. Spokane residents had the smallest, at 10.4 percent and 3.4 percent, respectively.

Because every city adds on its own sales, property, and automobile taxes, every city increases the regressivity of the state tax baseline. But among a series of regressive cities, Spokane manages to be the most progressive.

The spread of taxation also varied widely. No city taxed a household making $25,000 more than Seattle, and no city taxed a household making $250,000 less than Yakima. Yet the difference in taxation from city to city amounts to a 7.3 percentage point spread for low-income families and a 2.1 percentage point spread for the wealthy.

There were also many variations within those extremes.

Bellevue and Seattle have very different levels of regressivity, despite being close neighbors. The lower sales tax rates, car registration fees, property taxes and slightly lower rents (which result in lower imputed property tax payments) gave Bellevue residents at the lower end of the income spectrum lower tax obligations. A household making $25,000 in Bellevue renting an apartment paid $3,959 in total taxes while a similar household in Seattle paid $4,239, a difference of $280 or 1.1 percentage points.

Nonetheless, Bellevue taxes the wealthy at higher rates than any other city on the list. This is mainly due to property taxes. While a typical home-owning family in Seattle that earned $150,000 in 2016 had a property value of $477,500, that same family in Bellevue owned a home worth $695,000. So even though Bellevue had a lower effective property tax rate in 2016 (0.872 percent vs. 0.925 percent), that household in Bellevue paid 37.2 percent more in property taxes and 17.2 percent more in taxes overall.

No city has consistently lower or higher tax rates for any cohort. For example, home-owning households making $150,000 per year pay less in taxes in Wenatchee than in Bellingham (4.6 percent and 5.2 percent), but that switches when they make $250,000 per year (4.1 percent and 3.9 percent).

Figure 20

Nonetheless, there are some regional trends. Seattle and Bellevue almost consistently jockey for the highest tax rates at any household income level, as shown in Figure 20. Cities in King County tend to have higher tax rates than other cities in Western Washington, which in turn tend to have higher tax rates than cities in Eastern Washington.

Taken as a whole, the proportions of taxation match up with the statewide reports created by ITEP and the Washington State Department of Revenue. But they also show that the tax system is much more regressive in Seattle than in other cities, and its large population skews the state to be more regressive on average.

The culprits are as expected. In 2016, Seattle has much higher property values than most other cities, leading to higher taxes even with a lower property tax rate than everywhere but Bellevue. To finance public transit and other urban services, Seattle has a higher sales tax and more expensive car registration, despite a $20 rebate for low-income households.

The ranking is not a critique of the higher tax rates in Seattle and Western Washington. It’s not a surprise that cities in Western Washington have higher taxes. The cities tend to be larger, with a greater density and demand for services, and are growing faster than Eastern Washington cities. Out of the ten fastest-growing cities in the state in 2016, nine were in Western Washington.[82] Growing cities have development needs that require public investment and higher taxes.

The problem is that as Seattle and Western Washington cities work to fund public projects, they rely on regressive taxation methods, compounding the stress placed on lower- and middle-class incomes and broadening the gap between how much they pay compared to the very wealthy.

Effective taxes paid by the very wealthy in Seattle are 1 or 2 percentage points higher than in most other cities in Washington. Yet households making $25,000 can pay 7 percent more of their income in taxes just by living in Seattle. Even if public expenditures are relatively progressive in nature, city projects are increasingly being built on the backs of those who can least afford to pay for them.

Figure 21

In Seattle, 10 percent of the income for households making $25,000 went to property taxes (imputed) in 2016, versus 2.5 percent of the income for households making $250,000, as shown in Figure 21. Similarly huge discrepancies exist for sales taxes (3.3 percent versus 1.1 percent).

When you break down the differences in taxation into calendar days, households making $250,000 have received enough income to pay state and local taxes within the first three weeks of January, no matter where they are. But it takes at least five weeks for a household earning $25,000. In Seattle, it takes almost 9 weeks for a low-income household, meaning they work into March just to pay state and local taxes, as shown in Table 2. [83]

Table 2

3.4) Tax Obligations Are Increasing Faster for Working- and Middle-Class People Than for the Wealthy

The figures above use 2016 data because they are the most recent available. But Seattle has experienced major tax increases in the last two years.

The Legislature restructured state and local property taxes in 2017 to lessen reliance on local levies for school funding in its plan to meet the state Supreme Court education order known as McCleary. They increased the state property tax from $1.88 to $2.70 per thousand dollars of assessed value. This is expected to bring in $1.6 billion in new revenue in 2017-2019.[84]

While some property owners in districts with relatively low property values will see a reduction in total property taxes, property owners who live in Seattle and the surrounding Puget Sound area, regardless of income, will see significant increases in taxation. This is also likely to drive up the imputed property taxes paid by renters in the form of higher rents.

Homeowners in 85 school districts will have property tax increases of $200 or more. 24 school districts will have median property tax increases exceeding $300.

The median single family home in Seattle will see an increase in property taxes of over $400.[85]

In Seattle, the voter-approved Sound Transit 3 measure increased the sales tax from 9.6 percent to 10.1 percent.[86]

The Regional Transit Authority tax for Snohomish, King and Pierce Counties also increased from 0.3 percent to 1.1 percent, significantly increasing car registration costs.[87]

Using 2016 data and factoring in 2018 taxation levels changes the picture significantly, as shown in Figure 22.

Figure 22

The tax rate for households making $25,000 increased from just under 17 percent to just over 18 percent (1.1 percentage points), while taxes on households making $250,000 increased from 4.4 percent to 4.8 percent (0.4 percentage points). The 2018 tax system is more regressive than just two years ago. A household making $25,000 now has to work 4 more days, until March 7, to meet their state and local taxes.

Because they use 2016 data, the hypothetical 2018 calculations do not take into account recent rent and property value increases, which will further increase the gap in affordability and tax rates.

3.5) Seattle Has Exigent Problems to Solve to Help Everyone Thrive

[T]he main thing I point out when people start complaining about homeless immigrants is that the increases in homelessness around here aren’t just in Seattle, but all over urban King County. I don’t think people come from Alabama or Pennsylvania to Kent or Bellevue for the services, even with pot as an inducement. This leads me to think that probably most of the increase in Seattle, which is commensurate with those other towns’ increases, is also not immigration.

– Joe Bernstein, homeless Seattle writer, June 29, 2016[88]

Even as some Seattle residents become wealthier, the ability of city government to pay for the public services to keep the city running has become strained. While the total city budget amounts to $5.6 billion for 2018, this includes Seattle City Light, other utilities, sewage, recycling, garbage, and other fee-based services.[89] A more accurate picture involves general fund expenditures, totaling close to $1.3 billion. These have grown by about $350 million since 2008, when the general fund budget was $926 million – or $1.1 billion in inflation-adjusted dollars.[90]

Seattle’s population also grew significantly during that period, from 592,000 to 738,000 people.[91] Between 2008 and 2017, Seattle’s population grew by 21 percent and the city budget grew by 16 percent after inflation.

Figure 23

Seattle is actually spending more than $110 less per resident now than it did in 2008, at the start of the Great Recession, as shown in Figure 23.

Seattle’s general fund budget dropped from 2009 through 2012, as the Great Recession reduced revenues, before beginning to rebound in 2013. A favorite ploy of those opposed to robust public services is to measure increases in government spending from the trough, rather than from the period prior to a recession and its subsequent reduction in services. They do this to make it look like government went on a spending spree, rather than simply restoring services cut during the recession due to lowered revenues.

Since 2011, the number of people living without shelter has doubled, totaling 3,857 in Seattle in January 2017.[92] Tuition has increased 27 percent to almost $11,000 at the University of Washington, and increased 20 percent at community colleges, with tuition and fees exceeding $4,000.[93] Child care costs for infants in daycare centers in King County average $17,300 a year.[94] Seattle now has the fourth worst traffic congestion in the country.[95]

Rents have more than doubled, with the average cost for a single bedroom unit exceeding $2,000 a month, as shown in Figure 24.[96] Home prices have doubled, and Seattle has more construction cranes than any other city in the country.[97]

Figure 24

African Americans are being pushed out of the Central District and Columbia City by high prices, [98] as are LGBT people from Capitol Hill.[99] Elderly people in Wallingford are on the verge of homelessness.[100]

Heightened income inequality and economic instability strongly correlate with declining health[101] and increasing violent crime.[102] In Seattle, instances of rape more than doubled between 2010 and 2016,[103] violent crime increased by 22 percent,[104] underage prostitution increased,[105] and hate crimes became more frequent.[106]

The economy is booming, but not for everyone, as shown in Figure 25. While median income is increasing for residents with bachelor’s and graduate degrees, it’s on a downward trend for high school graduates and those with associate’s degrees. At the bottom of the spectrum, residents who did not finish high school have a slightly positive trend, primarily bolstered by the recent increases in the minimum wage.

Figure 25

3.6) Seattle’s New Soda Tax is Also Regressive; Seattle Needs New Tools

Today, we are on the march toward being a low tax, low service state. Of course the public feels as if Washington is a high-tax environment because we are irrationally nickeled-and-dimed in a fashion that doesn’t track with how people live their lives.

– State Senator Reuven Carlyle, former chair of the Washington House Finance Committee, January 5, 2015[107]

To build affordable housing, provide services for the homeless population, improve transit, increase access to affordable childcare, and enable free community college tuition, Seattle needs public revenue. But increasing regressive taxes already in place simply increases the burden on low-income residents to fund services that ultimately benefit everybody, while excusing the affluent from contributing proportionally to build the commonwealth of the city.

Even though Seattleites on average are getting richer, that income is mostly at the top. More than half of Seattleites still make less than $50,000 per year, according to their federal income tax returns.[108]

Not only do regressive taxes impact low-income households more, but they also unevenly affect residents by racial groups because of the correlations between income and race. Seattle is one of the whitest major cities in America,[109] in which white people as a whole are richer than any other race, as shown in Figure 26. More than 39 percent of American Indian and Alaska Native households made less than $20,160 yearly in 2016, as did more than 36 percent of African American households.[110] Being proportionally in lower income brackets means these groups also paid proportionally more in taxes.

Figure 26

But Seattle doesn’t have many progressive tax options to supplement or replace regressive taxes. In 2017, Seattle enacted the soda tax to generate $15 million per year in revenue in 2018.[111] The money raised will be dedicated to nutrition and education programs. The tax is also intended to dissuade people from drinking sugary drinks, as the tobacco tax is meant to discourage smoking.[112]

Regardless of its health outcomes, the tax is regressive, hitting poorer people harder. A 2006 Washington State University study of taxes on fatty and sugary foods similar in structure to the Seattle soda tax indicated that these taxes affected low-income families more than higher-income families both generally and because of diet choices. Households with incomes of $100,000 per year paid $24.29 in what the researchers called “fat taxes”, but households with $20,000 incomes paid twice as much – $47.38.[113]

A 2008 study published by the Journal of Urban Health found an association between soda consumption and race, age, and income. The paper found that individuals with low incomes were nearly twice as likely to purchase and consume soda as were those whose incomes were significantly higher. In addition, the proportions of U.S.-born African Americans, Puerto Ricans, and Mexican Americans who reported consuming more than one soda per day was more than twice that of whites. While the paper was based on a survey of 9,865 adults in New York City, the general observations likely hold true for most markets.[114]

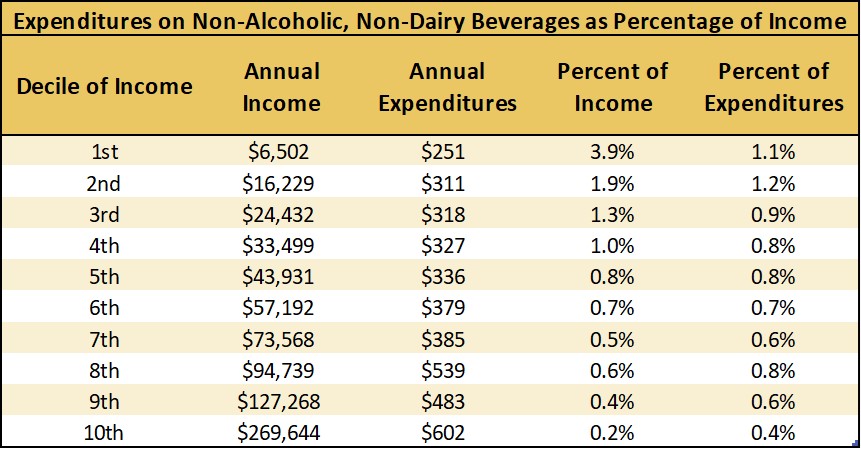

Data from the August 2017 Consumer Expenditure Survey back this up, as shown in Table 3.[115]

Table 3

The regressivity of the Seattle sweetened beverage tax is only compounded by exempting expensive high-calorie coffee drinks popular with higher-income people, i.e. anything from Starbucks.

A problem with raising sales and excise taxes is that they can go only so far before people start travelling to avoid them. Residents of Clark County already register their cars and buy goods in Oregon to avoid taxes, costing Vancouver $4.3 million and the county $10 million annually.[116]

The tax on soda encourages residents to leave the city limits to purchase soda.[117] This may increase regressivity, as it is not only easier for people on Seattle’s borders to purchase elsewhere, it is also easier for people who can afford to travel for shopping.[118] This also causes Seattle to lose tax revenue.

For the tax system to sustainably address Seattle’s challenges, Seattle cannot continue to become more regressive. Having a progressive tax option would also allow the city to lower regressive tax rates and lessen the tax obligation of lower-income people.

3.7) Lower Taxes on the Affluent Do Not Help City Job Growth

I once met Steve Ballmer when he was [CEO] at Microsoft. If I had the chance to meet him again, I’d tell him that what really makes an “unfavorable business climate” is tents lining our gridlocked highways, threats to our immigrant employees and underfunded schools for our children.

– Ned Friend, tech worker, July 9, 2017[119]

Cities that have lower effective tax rates on wealthier households do not have statistically significant better job growth than those with higher effective tax rates. Comparing full- and part-time wage and salary job growth from 2006 to 2016 to the high-income effective tax ranking from the District of Columbia report, there appears to be only the slightest correlation (R2 of .009), as shown in Figure 27. That means at least 99 percent of the difference in city job growth is unrelated to taxation on wealthy households.

Figure 27

Not coincidentally, the nine cities that do not have personal income taxes take up nine of the ten slots that tax higher incomes the least. But only Houston, Las Vegas and Sioux Falls were in the top ten for job growth. Memphis and Manchester did not fare nearly so well. Boise and Portland, OR, with two of the highest combined state and local income tax rates on the wealthy, fared better than Seattle.

When you compare cities with no personal income taxes and cities with high personal income taxes in a box-and-whisker plot, the hair-thin correlation melts away, as shown in Figure 28.

Figure 28

There is very little, if any, connection between low taxes on the wealthy and a region’s ability to generate jobs. Such a claim is simply a localized version of Reagan-style trickle-down economics.

Even if there were a connection, the question becomes one of morality. At what cost do we want more jobs and prosperity? Are job growth and tax cuts for the rich worth it if the byproducts are displaced communities, increases in homelessness, and collapsing infrastructure?

4) How the Income Tax on the Very Wealthy Will Help

Government is more than bureaucracy. Our schools, our parks, our fire stations, our buses, our police and our libraries are how we function as a community. Elementary schoolteachers and firefighters don’t benefit from an upside-down tax structure; the very wealthy do.

– Seattle City Councilmember Lisa Herbold, November 16, 2017[120]

4.1) What We Can Achieve with a Progressive Tax

In July 2017, Seattle’s City Council took the bold step of adopting a progressive income tax on the city’s wealthiest households. The language of the Seattle income tax ordinance creates the parameters for the expenditures of tax revenue. “All receipts from the tax levied in this Chapter 5.65 shall be restricted in use and shall be used only for the following purposes: (1) lowering the property tax burden and the impact of other regressive taxes; (2) addressing the homelessness crisis; (3) providing affordable housing, education, and transit; (4) replacing federal funding potentially lost through federal budget cuts, including funding for mental health and public health services; (5) creating green jobs and meeting carbon reduction goals…”[121]

The tax is a 2.25 percent tax on total income (line 22 of the 2017 IRS 1040 Form) in excess of $250,000 for individuals and $500,000 for joint filers.[122] That means a single filer making $300,000 per year would pay $1,250 under this new tax.

Note that none of the households represented in the comparison of tax rates among Washington cities would pay this tax. This is a tax extended only to the very wealthy, who already pay a much lower effective state and local tax rate than other residents of Seattle.

Not only will the income tax on the very wealthy help address exigent city needs, it will allow the city to relieve the tax obligations on the people who can least afford to pay.

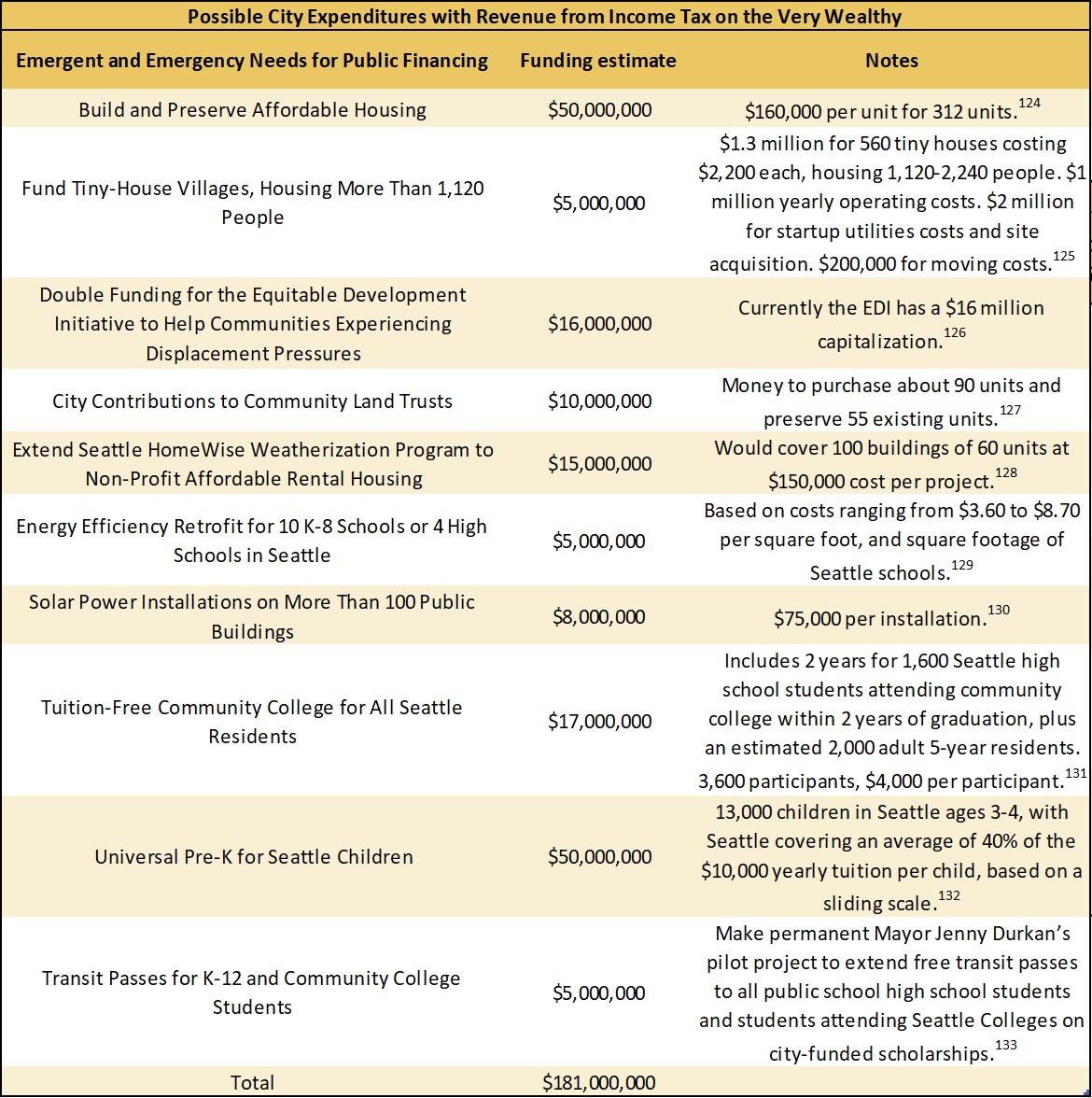

The City of Seattle estimates the income tax on the very wealthy will raise at least $140 million a year, that is, exceeding 10 percent of the city’s current general fund.[123]

Table 4 shows programs that could benefit from the tax.

Table 4

4.2) Seattle’s Income Tax on the Very Wealthy Doesn’t Hurt Small Businesses

Opponents to the income tax on the very wealthy like to say it will create hardships for small businesses, when it only affects the very wealthy business owners who choose to take much of their profit as business income in addition to their own salaries.

The tax referencing line 222 of form 1040 affects the profits of individual (non-corporate) business owners. Those profits are after accounting for nearly all expenses, including the salaries the business owners pay themselves.

For those taxpayers in the brackets that will be taxed, their business income (i.e., profit) accounts for just 3.4 percent of their adjusted gross income, based on Internal Revenue Service returns.[134]

There is a tax advantage in paying themselves more in salaries and retaining less as profits, since the latter would potentially be taxed again when eventually paid out to the small business owners.

To further put this in context of “hardship” for small businesses, about 95 percent of the total income tax revenue Seattle is projected to receive would come from taxpayers with adjusted gross incomes above $500,000. For those among these very high-income people who take some of their income as business income, they either elect to have very high salaries with smaller profits or they elect to have high salaries and high profits. There isn’t much hardship to be seen in either case.

The remaining 5 percent of the income tax revenue would come from individuals earning between $250,000 and $500,000. These taxpayers would pay an average of about $2,500. With business income accounting for about 3.4 percent of their income, that part of their tax would be on average about $84 per taxpayer.

But that’s with 2017 tax rates. The new Trump Administration tax rates will allow a 20 percent deduction for “pass through” income, where business income is passed through to the owner’s individual tax return. This will be reflected on line 22 of Form 1040.

5) Legal History

When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorizes it and a moral code that glorifies it.

– Economist Frédéric Bastiat, 1848.[135]

Washington has a regressive tax system in part because powerful interests have created a system to benefit themselves at others’ expense. Lumber magnates and rich businessmen won in the Washington Supreme Court in 1933; they don’t have to win again.

5.1) A Century Ago, When Washington Was More Progressively Minded

It was more popular on the ballot than bringing back the sale of beer.

– Geoff Crooks, former commissioner for the Washington Supreme Court, talking about the 1932 ballot initiative to create a progressive income tax during the times of Prohibition.[136]

Washington State used to like progressive taxes. In 1901, the state enacted a progressive inheritance tax, which through the years became the progressive estate tax we have today.[137] In 1921, the state enacted a progressive gas tax, as only the rich had cars at the time.[138] (That has since become regressive, as the rich move to hybrid and electric cars.)[139] In 1913, Washingtonians overwhelmingly supported the Federal Income Tax amendment to the U.S. Constitution.[140]

Property tax, however, was the main revenue source for the state government in the early 20th century, accounting for two-thirds of tax receipts.

Then, during the Great Depression, Washington State fell into fiscal crisis. An income tax proposal passed the Washington State Senate in 1929, but died in a House of Representatives committee. The Legislature provided for the appointment of the Tax Advisory Commission, which Governor Roland Hartley, a lumber magnate, filled with men he thought were in opposition to an income tax.[141] To his dismay, in 1931, this commission reported to the Legislature their support for a progressive income tax.

The Legislature took this recommendation and passed an income tax, only to have Governor Hartley veto this bill.

The fiscal crisis did not abate and in 1932, a broad coalition of advocates brought forward Initiative 69 to create an income tax.

Existing methods of taxation, primarily based on property holdings, are inadequate, inequitable and economically unsound. Present conditions point the need of a new subject matter for taxation, which should be based on the ability to pay. Earnings for a given period are a fair measure of such ability.

The people of the State of Washington, therefore, exercising herein their supreme power and fundamental right, declare their purpose hereby to tax all for annual incomes within the state as such, and not as property.

– Initiative 69[142]

Initiative 69 would have established a graduated income tax on taxable income, starting at 1 percent for the first $1,000 ($18,800 in 2018 dollars)[143] and stepping up, so that any income in excess of $12,000 ($225,300 in 2018 dollars) would be taxed at 7 percent.[144]

The Washington State Grange, the Farmers Union, the Farm Bureau Federation, the State Agricultural Council, the Tax Limit League, the Realty Boards, the Title Association, the Savings and Loan League, the Parent Teachers Association, the Education Association, the State Federation of Labor and the Women’s Legislative Council signed the voter’s guide argument in favor, saying its chief aim was “to relieve the excessive burden upon homes, farms and business properties by transferring a portion of the burden to those now paying little or nothing.”[145] No one argued against the tax.

Initiative 69 passed with an overwhelming majority, 70.2 percent in favor. In contrast, 62.1 percent voted to repeal the ban on selling beer.[146]

Two businessmen in the downtown Seattle business community sued the state of Washington to overrule the election results and prohibit an income tax, reaching the Washington Supreme Court.[147]

In 1933, the Court needed to make a ruling, but a pro-tax judge was ill from a heart condition. Governor Clarence Martin, in favor of the tax, appointed a new judge he was sure would approve it. But the well-paid justices had just received their tax forms in the mail, as had a slew of Washingtonians who were not even eligible to pay the tax. One of the pro-tax judges switched sides, and the Court declared the tax unconstitutional with a 5 to 4 vote.[148]

According to the Court majority, the income tax itself was not illegal; it was only a progressive income tax that was the problem. The rich should not have to pay more than the poor, the justices said, as that is injustice. Income is a form of property, which cannot be taxed at different levels under the state constitution. The lead dissent, written by Justice Bruce Blake, stated that the majority was engaged in “sheer sophistry” when it equated income with property, predicting fiscal doom for the state.[149]

The Legislature tried again in 1935, with passage of House Bill 513. [150] The act would have put into place an income tax of 3 percent on income in excess of $1,000 ($18,000 in 2018 dollars)[151] for a single person or $2,500 for a household ($45,900), increasing to 4 percent for income in excess of $4,000 ($71,800).

The governor signed it, but it was challenged again. The Supreme Court renewed its definition of income as property and shut the challenge down.[152]

But the state still needed money, so in 1935 the Legislature passed the first retail sales tax in the state, which has been increased or extended more than 30 times in the past 83 years.[153] Even in the early years, the sales tax was regressive – a 2 percent tax on everything except basic food items. When it became a reality, people at lower income levels started feeling overtaxed, and the movement for a progressive income tax dried up. This cemented the current system where the working class pays an effective tax rate multiple times higher than the rich.

5.2) Recent Efforts for Progressive Taxes

There have been several efforts at the state level, through legislative actions, constitutional amendments, and initiatives, which have all come up short in rectifying decisions of the 1930s court. The most recent statewide effort was Initiative 1098 in 2010. This initiative was based on the findings of the Washington State Tax Structure Study Committee, established by the Legislature in 2002. The committee had been tasked to examine alternative tax structures that would be more equitable, transparent, and economically neutral for taxpayers – with the caveat that most of the alternatives “contain no income tax.[154]

Despite this, the committee recommended a state income tax in its final report due to the “intrinsic advantages of the income tax itself, and the resulting advantages of replacing an existing tax [emphasis in original].”[155] In turn, it recommended lowering the sales and/or property taxes to create a fairer system.

The 2010 initiative would have put in place a 5 percent tax on income in excess of $200,000 for individuals and $400,000 for joint filers, and 9 percent for income in excess of $500,000 for individuals and $1,000,000 for joint filers.[156] Initiative 1098 would have also reduced the state property tax, and exempted over 80 percent of businesses from the gross receipts tax on business. It would have raised about $3 million a year, dedicated to education and health care, while taxing the most affluent 3 percent of Washingtonians.

In the midst of the Great Recession and a fierce opposition campaign, Initiative 1098 was decisively defeated, 64.1 percent to 35.9 percent.[157] But Initiative 1098 did pass in certain municipalities. Seattle overwhelmingly approved it with 63 percent of the vote, as shown in Figure 29. Olympia passed it with 56 percent of the vote, Pullman and Bellingham with 54 percent support, with several other smaller areas such as Port Townsend and Bainbridge Island approving Initiative 1098 as well.[158] In 2016, Olympia voters narrowly rejected an income tax measure with 52 percent of the vote.[159]

Figure 29

5.3) Seattle Breaks the Ice on Reimagining Equitable Taxation