Adopting a budget will be the main task of Washington’s legislature in 2015. The state’s elected leaders face a big challenge. Income inequality is constricting family budgets and the whole economy, here in Washington and nationwide. Washington also has an outdated tax system that no longer fits our economy. As a result, public revenues from sales and business taxes are growing a lot more slowly than the costs of educating our kids and providing basic services and infrastructure. To pass a state budget that provides a solid platform for thriving families and broadly shared prosperity, our legislature must raise progressive new sources of revenue and approve new policies to tackle inequality.

Washington’s economy needs a stronger foundation

Our state budget sets the foundation on which our economy and state residents can thrive. But the combination of recession, growing income inequality, and an outdated and inflexible tax system is undercutting that foundation.

- Washington has the 4th highest number of kids per teacher among all the states, and ranks 42nd in our level of investment in K-12 education.

- The share of state funding for higher education has fallen steadily for two decades, and plummeted with the recession. Among all states, Washington had the 9th highest tuition hikes between 2008 and 2012.

- Early learning, mental health services, child protection, senior health, state parks, and other key services have been underfunded through the recession.

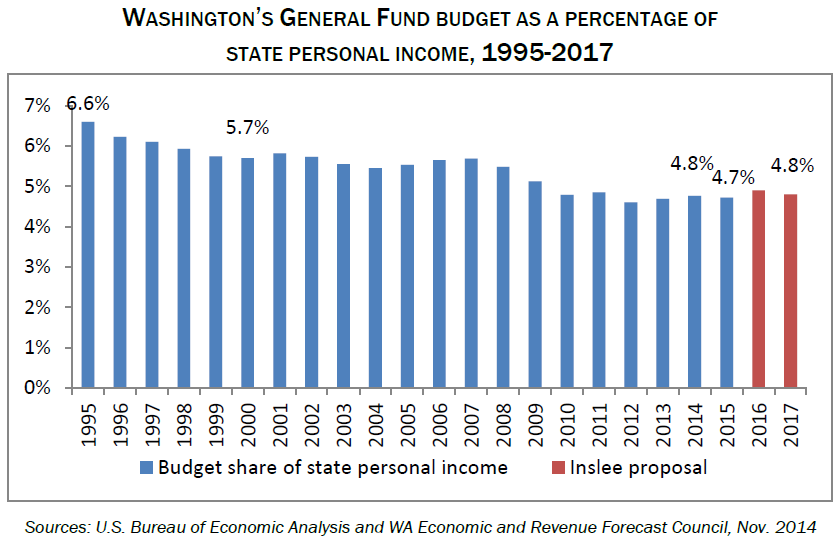

Over the past 20 years, Washington’s budget has declined as a percentage of the state’s economy. If revenues came in today at the rate they did in the year 2000, Washington would have an additional $3 billion each year to invest in education and other priorities. Many economists agree that cutbacks in government spending have prolonged the recession.

Washington State’s Budget: An Overview

Washington’s 2-year General Fund budget covering July 2012 through June 2014 totals $34 billion. Almost half is devoted to K-12 public schools, and another 9% to higher education. Health and human services make up another 30% of spending. Washington has separate budgets for transportation, largely funded by gas and related taxes, and capital projects.

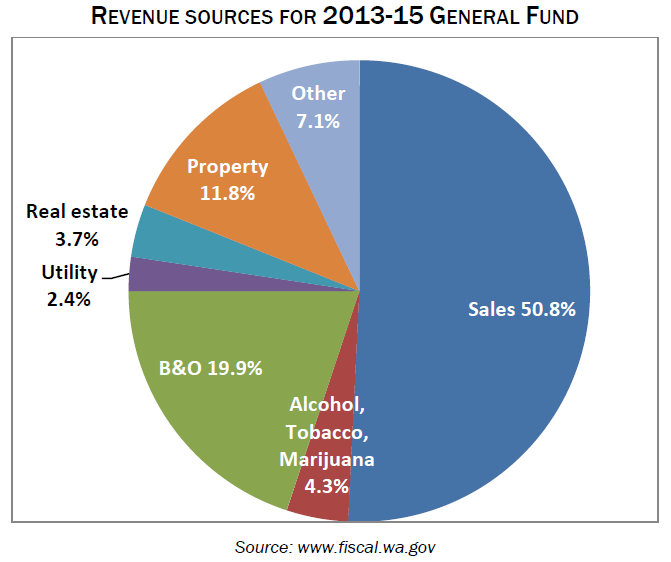

About half of Washington’s general fund revenues come from the sales tax. The state collects 6.5% on sales of most goods other than food and prescription drugs. Local cities, counties, and other special service districts also collect sales tax, so rates are as high as 9.5% in some areas.

The business and occupation tax (B&O) is the next biggest source of revenue. About 12% comes from the property tax, although the bulk of property taxes stay in local communities to fund roads, police, school and library bonds, and other basic services.

Improving services for an opportunity economy?

Washington is projected to collect about $2.7 billion more in 2015-17 than in the 2013-15 biennium – enough to cover the growing population of school kids and others, but no improvement in services. However, both the voters and the courts have told the legislature that services must improve.

In November 2014, Washington voters passed Initiative 1351 to lower class sizes in all grades. That requires more teachers, more class rooms – and more money. In the McCleary decision, the Supreme Court said the legislature must invest enough to insure that all kids have access to an education that will fully prepare them for life in the 21st century. Together those come to about $4 billion in added costs for 2015-17.

We also must invest more in early learning and higher education if we want to help all kids achieve their potential. Then there’s everything else the state does, like protect mentally ill people, children, and seniors. Most state services were cut to the bone during the Great Recession and also need more funding to protect public health and safety.

Income inequality and a flawed tax structure

Most other states modernized their tax systems years ago with a state income tax, so they can reap some benefit from the skyrocketing wealth of the 1% and plow those resources back into early learning, small class sizes, and affordable college educations. But Washington still relies on a 1930’s-style system based on the sales tax. As a result, we have the most regressive tax structure in the nation, with low and moderate income households and small businesses paying too much, and the wealthiest individuals and corporations paying relatively little.

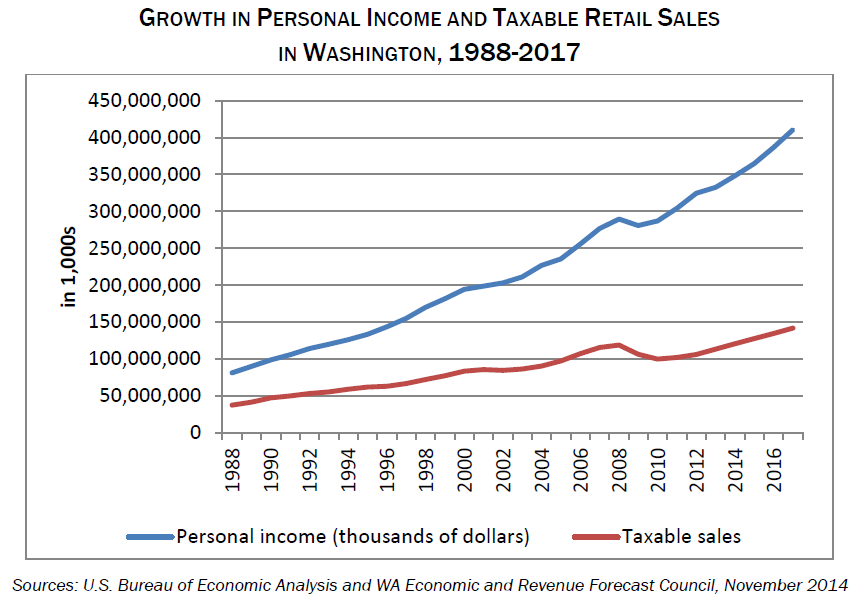

Sales tax revenues are growing more slowly than Washington’s population and economy for two main reasons. One is that people now spend more of their income than in earlier years on things that aren’t taxed: either services, such as health care and education, or on goods purchased over the internet, where sales tax collection is spotty. The other reason is the growing concentration of wealth among the top 1 or 2%, while incomes stagnate for the majority. Wealthy people simply cannot spend all their income.

Solutions for Washington’s budget dilemma

Progressive new revenues: Governor Inslee has proposed two new revenue sources for the state that will begin to address the fundamental shortcomings of our tax system. One is a 7% tax on capital gains from selling stocks and bonds. Retirement accounts and the first $25,000 would be exempt, so only the wealthiest would pay. The other is a new carbon tax that would be paid by the largest corporate polluters in the state. It would provide new money for education and transportation projects, while reducing pollution and slowing climate change.

Ending tax breaks: Washington’s tax code is full of special preferences for industries ranging from aerospace manufacturing to agriculture. Governor Inslee proposed ending a few tax breaks in his draft budget, but also added some new ones, including for high tech companies. A much more rigorous evaluation is necessary of which tax breaks actually create jobs and middle class consumers rather than merely padding shareholder profits and adding to the problems caused by income inequality.

Tackling systemic tax reform: Ultimately to provide educational opportunity for all in our state, while protecting public health and safety and establishing the foundations for thriving communities, Washington will have to modernize its whole tax structure. Over a decade ago, a bipartisan Tax Structure Study Committee recommended adopting a personal income tax, lowering the sales tax, and reforming business taxes to make the system less regressive, more stable, and better able to fund essential services.

Tackling income inequality: Providing individual opportunity and raising incomes for low and moderate income working families will also help our state’s revenue picture. More money in the pockets of hard working families means more economic activity, more jobs, and more public revenue. The 2015 legislature can help rebalance our economy by:

- increasing the state minimum wage to $12;

- passing statewide paid sick and safe leave so workers don’t lose income when they get sick or have a sick child;

- approving family and medical leave insurance, to provide paid leave for new parents and workers with serious health conditions or seriously ill family members;

- strengthening equal pay opportunity for women; and

- fully funding educational reforms from early learning through university.

More To Read

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits

January 29, 2025

Who is left out of the Paid Family and Medical Leave Act?

Strengthening job protections gives all workers time they need to care for themselves and their families

January 17, 2025

A look into the Department of Revenue’s Wealth Tax Study

A wealth tax can be reasonably and effectively implemented in Washington state