Throughout the 1980’s, wages for most Washingtonians tended to rise and fall together, regardless of whether you were at the top or bottom of the wage spectrum. But sometime in the mid-90’s, company decision-makers began boosting pay for high-wage employees. They’ve never looked back.

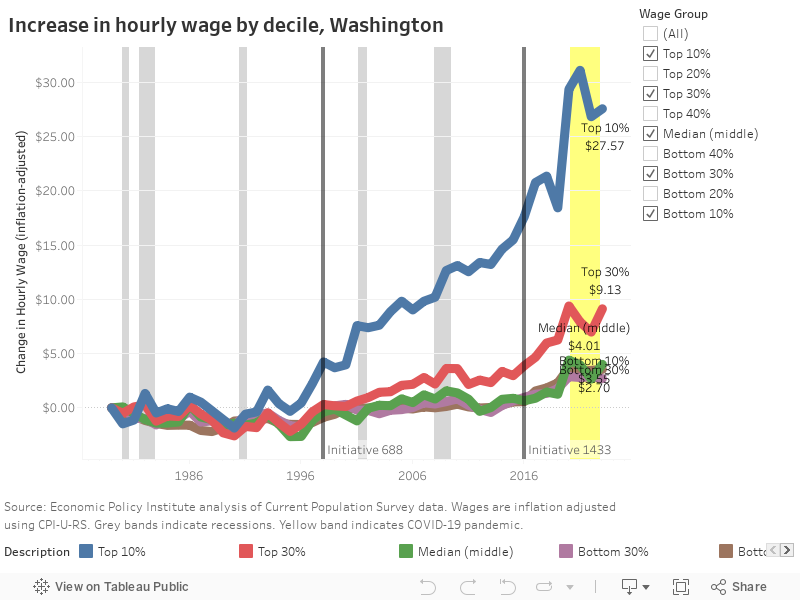

Since 1979, pay for the top 10% of wage earners in Washington has grown by nearly $28/hour – while wages for those at the median (middle) and in the bottom 10% have each grown only about $4/hour. (All figures are adjusted for inflation.)

All this has happened even as the state’s economy grew by leaps and bounds. For example: from 1997 – about when wage inequality in Washington really started taking off – to 2023, the state’s economy more than quadrupled in size, and per capita personal income nearly tripled. But those economic gains weren’t shared equitably; instead, they went almost entirely to the top, leaving most everyone else behind.

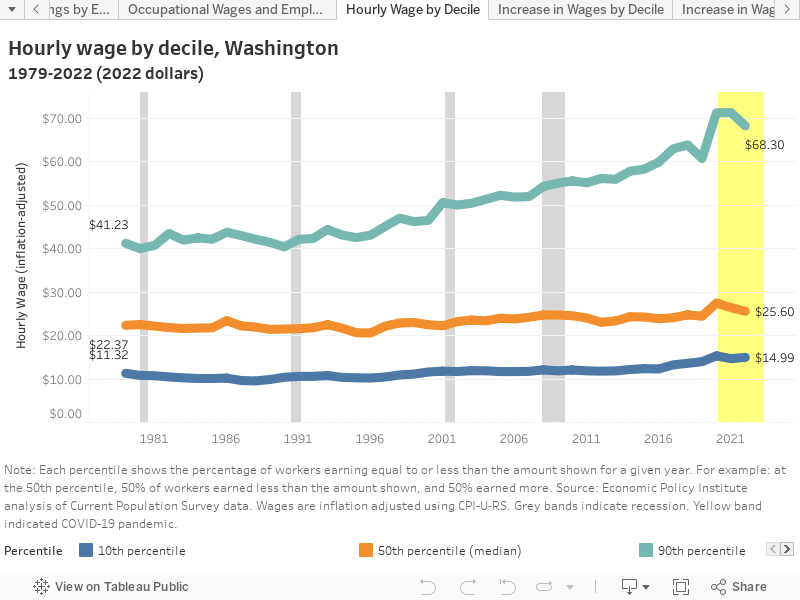

Let’s examine the wages for three groups: the bottom 10%, the middle (median), and the top 10%. In 1997, wages for the top 10% (~$47/hour) were two times higher than the median wage (~$23/hour), and the median wage itself was two times higher than that of the bottom 10% (~$11/hour).

Had the economic gains of the past 25+ years been shared equally, wages for all three groups would have risen while keeping those proportions the same. That’s not what happened. As of 2023, wages for the top 10% (~$72/hour) are 2.6 times higher than the median (~$28/hour), and the median wage is just 1.8 times higher than the lowest 10% ($15.70).

Excessive inequality can erode social cohesion, lead to political polarization, and lower economic growth. (Don’t take my word for it, that’s the IMF talking.) Combating it takes a range of policies, all of which require strong public institutions and laws to make a difference.

For example, recent changes to Washington’s overtime protections are helping bolster pay for (or give time back to) lower-paid workers. And changes to the state’s Equal Pay and Opportunities Act will help been significantly limit discrimination and unfair job practices.

But to really tackle inequality, state legislators and our next Governor must reform Washington’s upside-down tax code, which – by shielding millionaires and billionaires from paying their fair share – actually intensifies inequality in our communities by limiting public investment in affordable housing, childcare, transportation, health care, and other basic needs. Washington can – and must – do better.

More To Read

August 10, 2021

New State Programs May Ease a Short-Term Evictions Crisis, but Steep Rent Hikes Spell Trouble

State and local lawmakers must fashion new policies to reshape our housing market

November 20, 2020

We Can Invest in Us

Progressive Revenue to Advance Racial Equity