We’ve been pretending we can fund quality public services in Washington on the cheap, and now it’s catching up with us.

We need more from state services than a generation or two ago. We expect public schools to provide more challenging curricula with smaller class sizes, comprehensive special education, and counseling to help kids cope with life’s complexities. Jobs increasingly require education beyond high school, so we need more space in universities and community colleges. Our youngest kids need quality childcare and early learning so they have solid foundations for a lifetime.

Our recent economic growth hasn’t generated a corresponding level of revenue growth because our state’s outmoded tax structure demands a lot from struggling families, but lets millionaires and billionaires off the hook. And voters have repeatedly turned down a more balanced system that includes an income tax. So for years the legislature has passed budgets that shifted costs onto lower- and middle-income families, workers, and local communities.

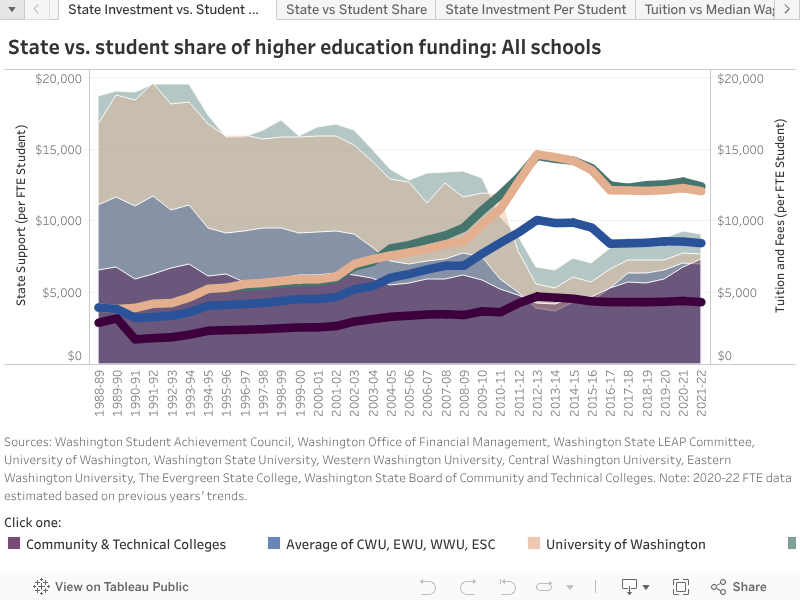

Earlier generations benefitted from affordable state-subsidized higher education, but over the past 20 years the state has drastically raised tuition. At the same time, staff at technical and community colleges in Washington are paid the equivalent of 12.4 percent less than in peer states. Washington also under-invests in childcare, while teachers barely make minimum wage and childcare centers struggle to keep the doors open. And local school district levies picked up more and more of the tab for improving public education – at least in wealthier districts – until the McCleary decision forced legislators to add billions for K-12.

This year, Democrats in Washington’s House have proposed a $53 billion two-year state budget that includes a new capital gains tax on the wealthiest, makes real estate excise taxes progressive, and raises the tax rate on high-profit tech and professional businesses. The Senate’s proposed budget is a little lower, ending some tax breaks instead of raising the business services tax and devoting their version of a capital gains tax to lowering several regressive taxes. These are steps in the right direction – but don’t come close to fixing the tax code or making up for years of underfunding.

The House Democrats proposal still only spends 5.2 percent of state personal income. In contrast, through the 1980s and most of the 1990s, Washington invested about 6.3 percent of total state personal income each year in public services. Then a series of tax cutting initiatives and the combined weight of growing income inequality and our regressive tax system ratcheted down the rate of revenue going to the state. From 2000 to 2009, the operating budget hovered around 5.7 percent of personal income. With the Great Recession, that rate collapsed even further.

If we spent now at the same level as just 10 years ago, we’d have $6 billion more for investments that help working families and communities thrive.

Critics of robust public investments emphasize that the dollar amount of the state budget has gone up every year, but that nominal rise gets eaten up quickly by inflation, population growth – up 80 percent since 1980, and the pressures of modern society.

Meanwhile, federal policies promote income inequality and keep wages for the majority flat. Individuals bear more of the burden of health care costs and the explosion of tech jobs has made housing is increasingly unaffordable in many parts of the state.

Republicans and their allies are united in declaring we don’t need new taxes. The pressure is on for Democrats to drop the capital gains tax altogether and to continue the erosion of state investments.

We can’t expect our state to meet current and future challenges, we can’t build opportunity and shared prosperity without a whole lot of new public revenue – from progressive sources.

Your legislators need to know what you think.

More To Read

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 6, 2024

Tax Loopholes for Big Tech Are Costing Washington Families

Subsidies for big corporations in our tax code come at a cost for college students and their families

July 19, 2024

What do Washingtonians really think about taxes?

Most people understand that the rich need to pay their share

Andrea Faste

We really need to move toward a state income tax, but if that is never going to pass, then the capital gains tax starts toward a fairer system.

Apr 7 2019 at 4:18 PM

Cindy Ann Cole

State Government needs to stop putting the burden of taxation only on the middle class and poor. I support a capital gains tax on the most wealthy in our state.

Apr 8 2019 at 9:09 AM

Alexis Annn Wallace

Propaganda lies. Teachers make plenty of $. This is public information. Look it up.

Apr 8 2019 at 9:06 PM

Georgia

We are taxed to death in this state, poor money management by our Leaders have created these problems. Taxing the wealthy will only have them pull out and go else where. We told our children they had to have a college degree . Then colleges started Jacking tuition , the student loan encouraged high interest loans , colleges would only have 1 class to finish your degree but you could never get in, by the time a person got into that class , he needed 3 more to graduate in his field . College is a trap , join an apprentice program , Learn to weld , use heavy equipment, be an electrician ..join the military .. better than ending up deep in debt . working at some place you hate .

Apr 10 2019 at 9:28 PM

David Champion

All the state Gov does is sit over there an think up ways to steal our money . You forgot to mention the extra money the state took in because the economy is doing well an extra 4 billion or something like that. How about the voters voting down there carbon tax last year and now you guys just add a new gas tax ? The leach has two daughters they cry more more more.

Apr 11 2019 at 2:06 PM