A recent flurry of publications has documented a rise in wealth among U.S. women. In general, women are earning more than they did two decades ago – which has contributed to a narrowing of the pay gap. But men’s earnings have also been on the decline and the pay gap still exists – and it’s not going anywhere any time soon.

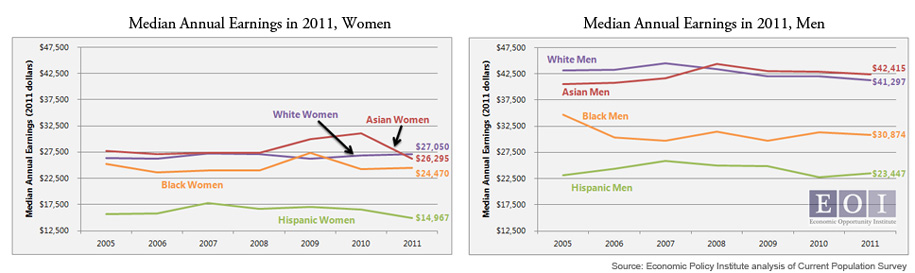

Here in Washington, women at the median took home just 66% of men’s earnings in 2011, with annual earnings of $25,803 compared to men’s $39,269. When broken out by racial group, the same storyline emerges. Within every group men are out-earning women, with the largest gaps among Asians and Whites.

And here’s the kicker: no group’s median earnings have seen significant and sustained improvement. And it’s not just due to the recession. Asian women were making gains through 2010, before taking a dive again in 2011; and Black men’s earnings began falling even before the Great Recession hit.

While it’s true that women are more likely to work part-time, the gender wage gap exists even among full-time, year-round workers. On par with national statistics on median wages, Washington women working full-time took home a paycheck that was just 77% of men’s, mirroring the gap in hourly wages.

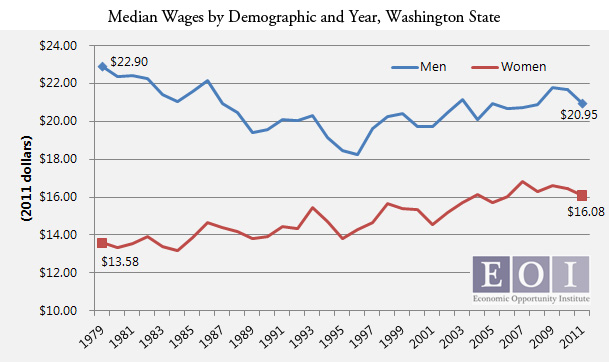

Median hourly pay for Washington women was $16.08 in 2011 – 77% of men’s $20.95. This is an increase compared to the 59% of inflation-adjusted earnings in 1979. However, little has changed from 1994 when the wage ratio first reached 77%. Since then, women’s earnings peaked at 81% of men’s in 2007, only to fall again over the recession.

Overall, just about everyone’s earnings are down since the start of the Great Recession. But while some some increases are expected as the economy gets back on track, the gender wage gap will no doubt remain significant throughout the recovery and recessions to come.

More To Read

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 10, 2024

Big Corporations Merge. Patients Pay The Bill

An old story with predictable results.

September 6, 2024

Tax Loopholes for Big Tech Are Costing Washington Families

Subsidies for big corporations in our tax code come at a cost for college students and their families