In the 1950s and 60s, the American middle class grew from the “middle out” thanks to government policies encouraging education and home ownership. There was also plenty of demand for American-made goods, as much of Europe’s manufacturing base had been destroyed during WWII. Times weren’t good for everyone – most notably African Americans, Japanese Americans, and other groups that suffered from de jure racism – but expansion of the U.S. economy led to one of the most prosperous societies in history.

In the 1950s and 60s, the American middle class grew from the “middle out” thanks to government policies encouraging education and home ownership. There was also plenty of demand for American-made goods, as much of Europe’s manufacturing base had been destroyed during WWII. Times weren’t good for everyone – most notably African Americans, Japanese Americans, and other groups that suffered from de jure racism – but expansion of the U.S. economy led to one of the most prosperous societies in history.

Single-income families were the norm, high student loans were virtually unheard of, and good benefits like pensions and health care were the rule – not the exception. So what’s happened since then?

Although gains in productivity translated to increased wages through the early 1970s, compensation has remained essentially flat since then despite a two-fold increase in productivity.

Bearing a striking similarity is a chart showing the average income of the top 1% versus that of the 99%. The gains are even more startling when breaking out the top 1% by 0.1% and 0.01%. This chart makes it clear that the vast majority of monetary gains from productivity went exclusively to those at the top.

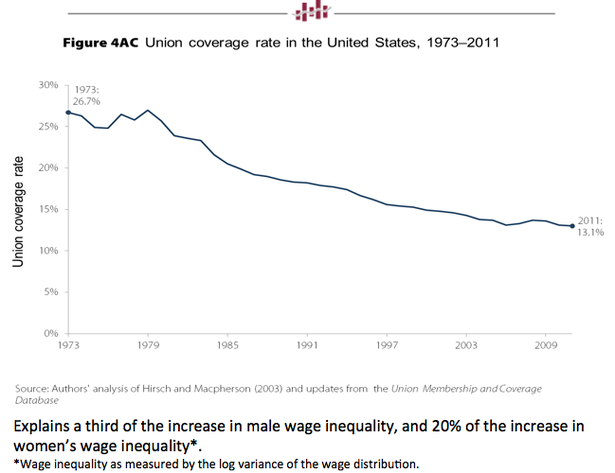

Why did this happen? Derek Thompson at The Atlantic magazine explains: “As manufacturing eroded, so did unions, whose coverage fell from 27% in the early 1970s to just 13% in the late 2000s. Without unions, middle class workers without skills to move into higher-paying jobs lacked the collective power to bargain for higher wages.”

There’s a dozen more charts over at The Atlantic article – plus plenty more explanation.

More To Read

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits

January 29, 2025

Who is left out of the Paid Family and Medical Leave Act?

Strengthening job protections gives all workers time they need to care for themselves and their families