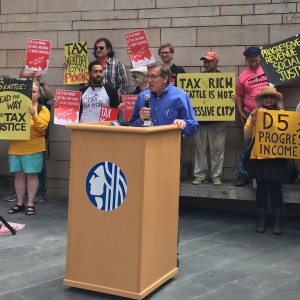

John Burbank emceeing the pre-vote rally.

Just a few months after the Economic Opportunity Institute and Trump Proof Seattle proposed a tax on the wealthy, the Seattle City Council has come through. Just this afternoon, the council unanimously voted to create a city income tax to help finance priorities like the homelessness crisis, providing transit, offsetting federal budget cuts, and reducing current regressive taxes, including property, B&O or sales taxes – safeguarding economic opportunity for all Seattleites.

The legislation will place a 2.25% tax rate on income over $250,000 year for individuals, or $500,000 for married couples filing jointly. The tax will not affect any income earned below those thresholds.

“With this income tax, merely eight months after Trump was elected President, Seattle is again leading the way forward with progressive and equitable public policy which helps our citizens, regardless of the shenanigans in Washington DC!” says EOI Executive Director John Burbank.

Before the vote, John Burbank hosted a rally in front of city hall, including speakers including Councilmembers Lisa Herbold, Kshama Sawant and Mike O’Brien; Seattle City Attorney Pete Holmes; Nicole Grant, executive secretary-treasurer of the Martin Luther King, Jr. County Labor Council; Michael Tamayo, vice president of the Seattle Education Association; Katie Wilson, general secretary of the Transit Riders Union; and Tiffani McCoy, organizer for Real Change.

In session, Councilmembers Sally Bagshaw and Kshama Sawant personally thanked John Burbank for his income tax work, as did a bevy of attendees who came to speak.

But the fight isn’t over yet. the rumblings of lawsuits have already appeared on the horizon. But check out this quote from Crosscut:

“We have made no secret of the fact that we’re entering into disputed legal territory,” said Katie Wilson, the lead organizer for Trump-Proof Seattle. “We’ve made no secret of the fact that we don’t expect the city to get revenue for at least a year and a half, pending the court’s decision.

“But you know what? When people hear this, it doesn’t make them any less willing to support this effort. If anything, it makes people feel even more urgency to take a stand and press forward.”

But, as Seattle Weekly points out, just because this happened quickly this year, doesn’t mean there weren’t years of preparation behind it:

How did an income tax—which will inevitably be appealed to the state Supreme Court—go from a progressive pipe dream to gaining the full support of the Seattle City Council and mayor in just a few months? The short answer is: It didn’t. Passing the income tax took years and multiple failed attempts, the rotten guts of which served as compost for this year’s blossoming effort.

John Burbank and Katie Wilson have been working on this for years. Cheers to their success!

More To Read

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits

January 29, 2025

Who is left out of the Paid Family and Medical Leave Act?

Strengthening job protections gives all workers time they need to care for themselves and their families

January 17, 2025

A look into the Department of Revenue’s Wealth Tax Study

A wealth tax can be reasonably and effectively implemented in Washington state