Our state needs tax revenue to fund all of the things we love and rely on. From public schools and universities to firefighters and so much more, taxes are essential. But the way we raise those funds matters. Unfortunately, Washington does not collect taxes equally. We have a potential solution, though: A wealth tax.

Washington’s tax structure is the most unfair in the nation. The way it’s written, most of the burden is placed on working families. It’s also rigged to protect the wealthiest and most powerful among us from paying their share.

As a result, regular people feel immense strain in their own budgets – but our essential programs and services are chronically underfunded. Meanwhile, the very wealthy are sheltered from paying into these public systems – systems which ultimately benefit them.

It doesn’t have to be this way.

Currently, half of Washington state’s revenue comes from the sales tax. The sales tax is a tax on everyday purchases. It’s a small amount, but for people who are watching every penny, it can really add up. This is considered a regressive tax because everyone pays the same percentage on purchases whether they’re making the minimum wage or they’re a multi-millionaire. That means that a sales tax is disproportionately steep for someone with less money, while someone who is very wealthy doesn’t feel the difference. Additionally, a flat sales tax doesn’t take into account categories like basic back-to-school clothes or luxury goods.

But this isn’t the only way that the tax code impacts everyday people in an unfair way. The way our state collects taxes actively protects the wealth of multi-millionaires and billionaires by allowing it to grow tax-free. This policy choice – and it is a choice – means our state budgets get built off of regressive taxes. It’s both unfair and ineffective; our publicly-funded systems are constantly underfunded while we also choose to large sums of money on the table.

Legislators can close this loophole through a state wealth tax.

While a wealth tax would be a new policy for Washington state, when viewed in context of our current state taxes, it’s clear that it’s a missing piece of the puzzle.

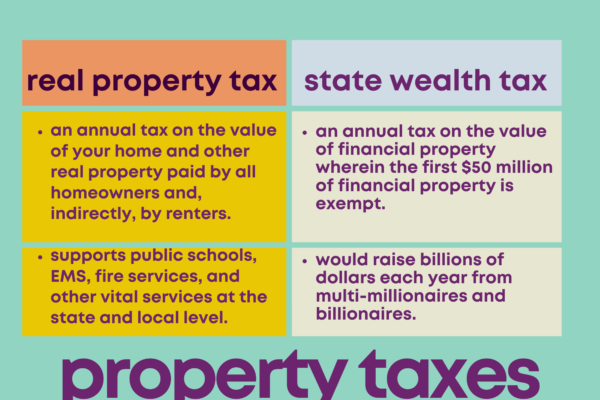

A state wealth tax is a property tax on the financial assets of Washington’s multi-millionaires and billionaires. This includes things like corporate stocks and bonds, which tend to make up the wealth of the very rich. In contrast, middle class families hold almost all their wealth in their home, on which they pay an annual state property tax. This important tax helps support vital services, such as public schools, but it can’t cover all of our state’s expenses. Until we pass a state wealth tax, there are no state or federal property taxes on the kinds of financial property that the wealthy enjoy. In other words, everyday Washingtonians pay what they owe each year on the value of their homes, but the extremely rich watch their wealth grow, tax-free, year after year.

In 2021, lawmakers took an important step toward ensuring the wealthy pay what they owe by passing the tax on capital gains. This is an excise tax on the sale of financial assets, like stocks and bonds. This tax would ensure that the ultra-wealthy are paying taxes on the activities that make them even more rich.

Homes are also taxed when sold through the real estate excise tax. So, when it comes to sales of real property versus financial assets, legislators have introduced a more equitable structure by passing the capital gains tax. However, when it comes to property taxes, the current system more costly for regular people. Passing a wealth tax will close this loophole.

Put together, it’s clear that the wealth tax is a missing piece of this tax puzzle

This isn’t just a theoretical discussion of taxes. Protecting a few billionaires’ wealth deprives thousands of regular people access to adequate resources and necessary programs that help us thrive.

This isn’t just a theoretical discussion of taxes. Protecting a few billionaires’ wealth deprives thousands of regular people access to adequate resources and necessary programs that help us thrive.

By taxing just a handful of our state’s wealthiest residents, we could help families put healthy meals on the table every day and take ample, paid time to heal when we are sick. Families who are less burdened by unfair taxes can live pursue dreams like going to school debt-free or investing in the family business.

In a state with 100 billionaires, we should not be balancing budgets on the backs of working people. It just doesn’t make sense.

Passing a wealth tax will ensure that the wealthiest in our state – those whose wealth is growing tax-free – pay what they owe.

More To Read

January 6, 2025

Initiative Measure 1 offers proven policies to fix Burien’s flawed minimum wage law

The city's current minimum wage ordinance gives with one hand while taking back with the other — but Initiative Measure 1 would fix that

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 6, 2024

Tax loopholes for big tech are costing Washington families

Subsidies for big corporations in our tax code come at a cost for college students and their families

Marcia Brown

We need to make our Tax Structure more adequate and fairer. A Wealth Tax would hep.

Dec 11 2022 at 5:02 PM

Tex Hooper

I think you are right about passing the tax on capital gains. I recently sold some stock and need to know how to file for it. I’ll have to get an accountant.

Feb 27 2023 at 6:41 PM

Tarhib IT

The idea of a wealth tax has been gaining traction in recent years, as a way to address the growing inequality in the United States. In 2022, Representative Jamaal Bowman introduced the “Babies over Billionaires” Act, which would impose a 1% tax on wealth above $100 million. The act is currently in committee. I really appreciate the insights you provided in your blog. Thank you for sharing this valuable information.

Nov 13 2023 at 12:50 AM