Tax Day 2012 is the latest scene in the national debate over who pays how much in federal taxes – and to a lesser extent, how some avoid them altogether. Here in Washington state, nearly everyone pays some taxes in one form or another – but the state’s tax code gives high-earners an (almost) free ride, quite literally passing the buck to lower- and middle-class individuals and families.

Our state’s public services (like K-12 schools, public colleges and universities, road and bridge maintenance, health care for seniors, etc.) are funded by three types of tax – sales, property and business – that constitute the majority of state revenue. That means virtually everyone pays some taxes: on non-food retail items, when registering a car or boat, or settling up property taxes.

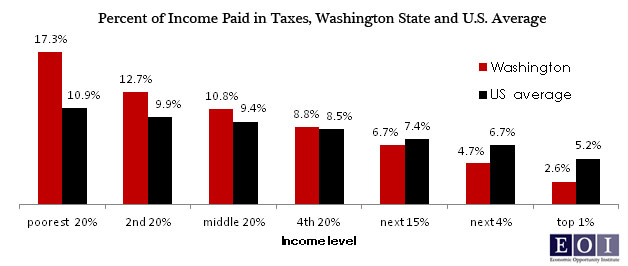

But because Washington state relies so heavily on sales tax revenue, low- and moderate-income people in Washington pay more in state and local taxes than they would in other states, while high-income Washingtonians pay less.

According to the Institute on Taxation and Economic Policy, Washington state has the most regressive taxes in the nation – a “soak-the-poor” system in which the the poorest 20% of (non-elderly) families pays 17.3% of their annual income in state and local taxes, while the top 1% pays a measly 2.6%.

ITEP isn’t alone in their findings. A 2010 analysis by the District of Columbia found the annual total of state sales, property, and auto taxes paid by a family of three in Seattle with an annual income of $25,000 amounted to 11.3% of their income. An equivalent family with an income of $50,000 paid just 8%, and one with $150,000 paid only 4.3%.

Why do sales taxes hit low and middle-income people so hard? Because the less money you make, the more of your money you spend on life’s essentials – and that’s when you pay sales tax. A higher income means you spend less of it, proportionally, and thus pay a lower effective sales tax rate. In other words: when your income rises in Washington, your state and local effective tax rates drop.

Reversing this inequity, and bringing more fairness to the tax code, can be achieved by ending some of the hundreds of special interest tax exemptions, lowering the rate of the regressive sales tax, and instituting a progressive income tax.

Matthew Gardner, lead author of the ITEP report that rated Washington’s tax structure as the most regressive, offers this analysis: “The lack of a progressive income tax to offset regressive sales and excise taxes, as well as property taxes, is the most important factor in making the Washington tax system so regressive. Taxes ought to be based on people’s ability to pay them, which means that the share of income paid in tax should rise as income grows, not fall sharply as is the case in Washington.”

More To Read

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits