If I claimed that a lion is a big animal while holding a teacup poodle in my hands, few people would argue. But if I said so while standing next to a life-size replica of a blue whale, most would likely disagree.

Context is key when making comparisons — but too often, it goes missing in discussions of Washington’s budget. Typically, people compare the current budget to the previous one and…that’s all. There’s no historical overview, much less any discussion of the people most affected by budget choices, or how the state’s tax code shapes spending.

So here are three key pieces of context for the Washington’s 2021-23 biennial budget, which is still being shaped by state lawmakers:

- Relative to the number of children, young adults, families, seniors and others served (in K-12 schools, higher education, and social and human services), state spending is at its lowest point ever since 1984.

- Relative to other states, Washington has the most upside-down tax code in the nation: as a share of their income, the wealthiest pay just a fraction of what the poorest do in taxes.

- Relative to Washington’s economy, state spending is still well below pre-Great Recession levels — and far below historical spending levels.

Economic and Historical Context

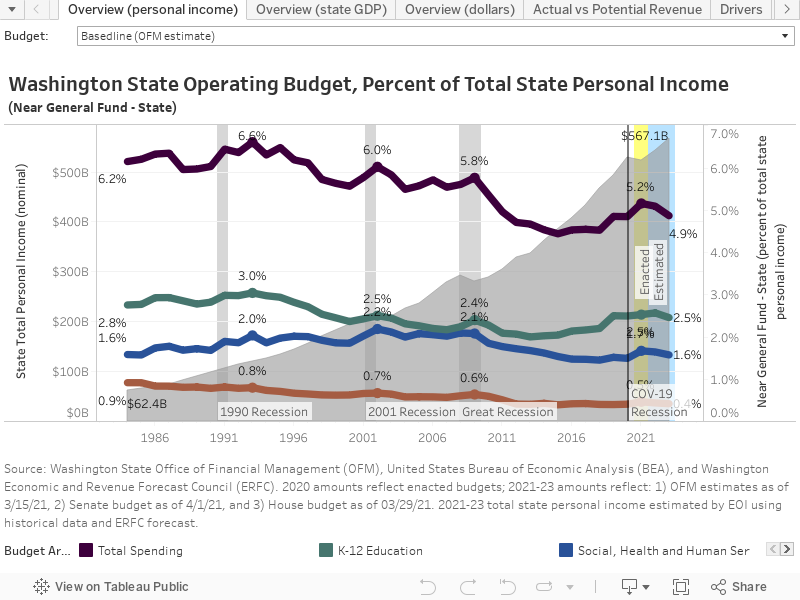

The visualization below shows yearly state spending as a percentage of total personal income in Washington. This shows us — relative to the size of the state’s economy — how the state’s budget has grown or shrunk over the past several decades. (We see similar trends using another common measure of the state economy: gross domestic product.)

In this context, a few things jump out:

- Through 2020, we’ve restored just one-third of the budget cuts enacted in the wake of the Great Recession: state spending was 5.8 percent of total personal income in 2009, bottomed out at 4.4 percent in 2015, and was just 4.9 percent in 2020.

- Following each of the past three recessions, state spending never returned to previous levels.

- 1993 was the high-water mark for state spending, at 6.3% of total personal income.

Population and Services Context

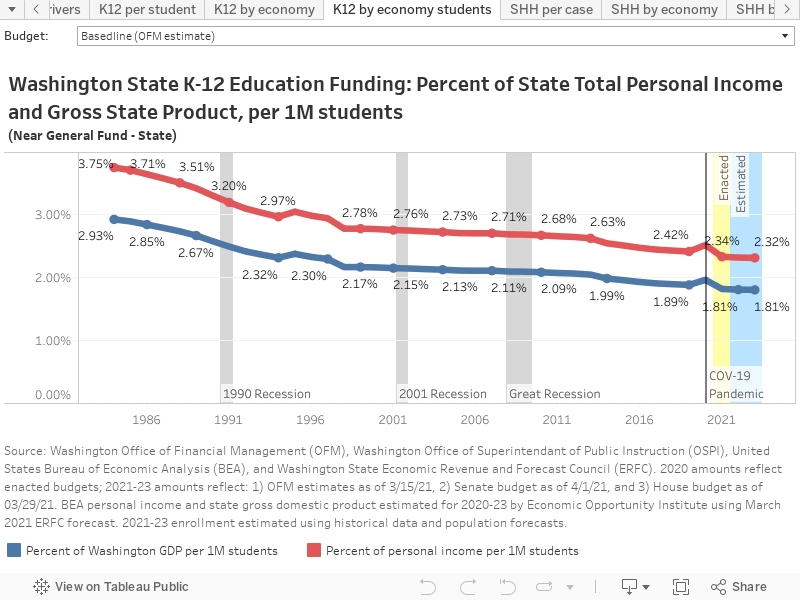

It’s also crucial to consider the people our public investments serve and invest in: we need the context of changing populations, caseloads, enrollments, etc.

The visualization below shows Washington’s yearly K-12 education spending per 1 million students, both as a percentage of state total personal income and gross domestic product. The 2020 increase is due to a drop in enrollments during the COVID-19 pandemic.

In this context, it’s clear the state has been disinvesting in K-12 education since 1984. The same trend is visible in social, health and human services, and higher education spending.

Revenue Context

Clearly, Washington is wealthy enough, on the whole, to afford additional investments in education, health, housing and more. Adjusted for inflation, total yearly personal income in Washington has more than doubled, from $217 billion in 1993 to $523 billion in 2021, an increase of 148 percent.

So why didn’t public revenue keep up? Because the vast majority of that income increase went to the wealthy few, and Washington’s tax structure gives them lower tax rates than everyone else.

We can estimate how much this unbalanced tax structure has cost us in lost revenue, which could have been invested in our students, seniors, families, workers and vulnerable populations — the kinds of investments that build individual opportunity, healthy communities, and shared prosperity.

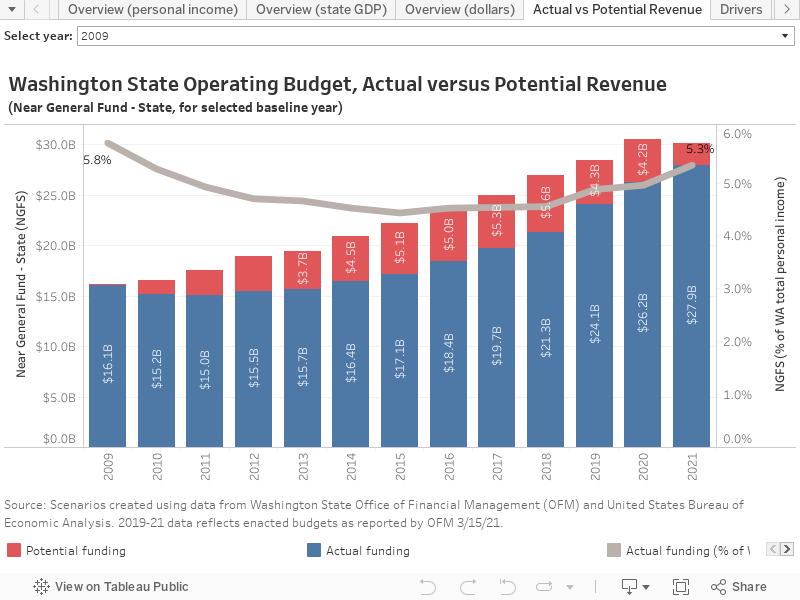

The visualization below shows how much additional revenue Washington would have had each year if legislators had reformed the state’s tax code to keep revenue at a constant percentage of total personal income.

Using 2009 as the base year, Washington would have had an average of $3.9 billion yearly to invest in public services over the past 12 years — and today the state’s budget would be the same size it was then, relative to our economy.

What We Can Do

We can’t go back in time to urge lawmakers to fix Washington’s broken, unfair tax code — but we can urge them to make the right choices this year to enable investments in education, health, housing and other public needs going forward.

Lawmakers in both the House and Senate are hammering out the differences between their respective budget proposals. Reach out to your Representative and Senators and encourage them to support proposals that will correct the inequities in our state’s tax code and generate new revenue to help educate, house, and ensure access to health care for all of our residents.

As noted in EOI’s From Affluence To Prosperity brief, several measures on the table in Washington’s 2021 legislative session could move the state toward greater prosperity:

- Tax on Extraordinary Capital Gains (SB 5096): A 7% tax on income from stocks, bonds, and other assets that exempts retirement accounts, sales of homes or farms, and investment earnings of less than $250,000 per individual. Most other states tax this income. It will raise $500 million annually beginning in fiscal year 2023.

- Estate Tax Reform (HB 1465): Exempts estates of deceased state residents valued less than $2.5 million and raises rates on the largest estates, generating about $100 million annually to be dedicated to housing security assistance and a new Equity in Housing Fund.

- Wealth Tax (HB 1406): A new 1% tax on the total value of stocks, bonds, and other intangible assets — over a threshold (still to be set) between $100 million and $1 billion. At the $1 billion threshold, fewer than 100 of our state’s wealthiest individuals would pay the tax, and it would raise $2.5 billion annually beginning in 2023 to invest in childcare, public health, access to higher education, and a more equitable and sustainable economy.

- Closing Investment Tax Break (HB 1111): Closes a tax break that encourages corporations and nonprofits to stash excess wealth in stocks and other investments, rather than lowering prices, investing in research, or raising wages for rank-and-file employees. Most states tax this income through corporate income taxes, but Washington does not. Eliminating this tax break could generate about $250 million annually to reinvest in health care and other vital services for state residents.

More To Read

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 6, 2024

Tax loopholes for big tech are costing Washington families

Subsidies for big corporations in our tax code come at a cost for college students and their families

July 19, 2024

What do Washingtonians really think about taxes?

Most people understand that the rich need to pay their share

Susan Fox

This is brilliant! Thank you for much needed context!

Apr 10 2021 at 8:09 AM

Gordon White

It is very helpful to have this historical context and to see the key points of investment and revenue history. Our state has moved in a more equitable social and political place (strong voting and other civil rights, policing reforms). Yet the method for raising investment dollars for our communities is stuck in a system that preserves the wealth of the few at the expense of the many. Thank you for providing the context to show how wealthy citizens fail to contribute our statewide needs.

Apr 10 2021 at 8:25 AM

Russell Lidmsn

Very fine work. The charts drive home the point.

Apr 12 2021 at 12:46 PM