A recent Politico-George Washington poll conducted in “battleground” states asked respondents how they would reduce the federal budget deficit.

A significant majority of voters indicated strong support for two proposals: raising taxes on households earning more than $250,000 (60% favor), raising taxes on corporations (64% favor).

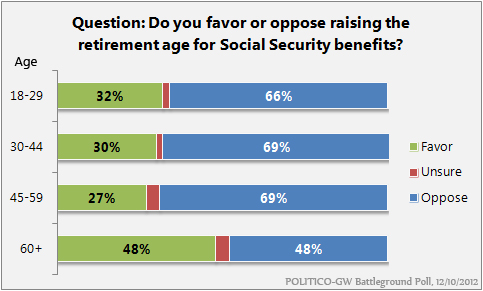

Voters also opposed raising the retirement age for Social Security benefits, with 64% against the idea. Interestingly, strong opposition came from young people age 18-29, 66% of whom opposed raising the retirement age. Opposition was strongest among Gen Xers (30-44) and those nearing retirement (45-59), at 69%.

Such strong opposition to raising the retirement age may be read as self-interest, but I think there’s something else going on here, especially among younger generations. Young people want their parents to have economic security in retirement, and Social Security is the foundation of that security. Many Americans nearing retirement had their savings decimated by the recession, fewer have access to pensions, and home values – which represent much of the wealth of middle class families – may not return to pre-recession levels anytime soon.

This leaves Social Security as the only guarantee in retirement, and Americans of all ages are willing to stand up and defend one of the best systems in America. That and they don’t want their parents moving in with them.

More To Read

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 10, 2024

Big Corporations Merge. Patients Pay The Bill

An old story with predictable results.

September 6, 2024

Tax Loopholes for Big Tech Are Costing Washington Families

Subsidies for big corporations in our tax code come at a cost for college students and their families