In a recent court decision favoring the for-profit education industry, a federal judge struck down a provision of the “gainful employment regulations” designed to ensure for-profit colleges were preparing students for the workforce without saddling them with unaffordable debt.

In a recent court decision favoring the for-profit education industry, a federal judge struck down a provision of the “gainful employment regulations” designed to ensure for-profit colleges were preparing students for the workforce without saddling them with unaffordable debt.

This ruling, in addition to millions spent on lobbying to weaken consumer protection standards, has ensured minimal regulation of the for-profit education industry.

But a scathing report (summary) released yesterday by the office of Iowa Senator Tom Harkin reveals how unscrupulous practices and lax oversight have resulted in a for-profit education industry that seems more concerned with turning a profit than educating students.

Harkin’s report is the result of a 2-year Senate inquiry into the operation of the for-profit education industry, with plenty of eyebrow-raising findings. Here are the highlights lowlights:

- Large numbers of students fail to earn degrees from for-profit colleges – with associate degree programs averaging a 64% dropout rate.

- For-profit colleges spent an average of 23% of their total budget on marketing, 19% on profit, and 17% on instruction.

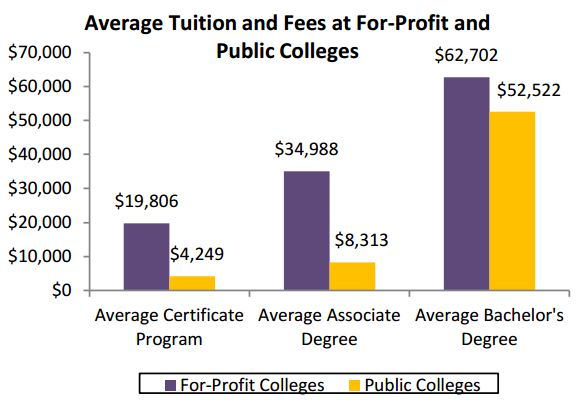

- Most for-profit colleges charge higher tuition than comparable public colleges, with associate and certificate programs averaging about four times the cost of such programs at community colleges.

Given high CEO compensation and low relative investment in instruction, the report also raises questions about how for-profit colleges get their funding. In 2009-10, the for-profit college sector received $32 billion in public funds – 25% of all Department of Education student aid program funds. In addition to those funds, for-profit colleges accounted for $7.5 billion in Pell grants, 37% of GI Bill benefits and 50% of Department of Defense Tuition Assistance funds – but they trained far fewer students than public colleges because of their cost.

The summary report concludes with a set of recommendations designed to increase protections for students, strengthen oversight of financial aid, and enhance transparency about graduation and job placement rates.

More To Read

January 29, 2025

Who is left out of the Paid Family and Medical Leave Act?

Strengthening job protections gives all workers time they need to care for themselves and their families

January 17, 2025

A look into the Department of Revenue’s Wealth Tax Study

A wealth tax can be reasonably and effectively implemented in Washington state

January 13, 2025

Meeting the Moment: EOI’s 2025 Legislative Agenda

This session, lawmakers must pass multiple progressive revenue solutions to fund the programs and services that help make Washington communities affordable