Income inequality is still on the rise as the nation struggles to recover from Wall Street’s recession

In 2007, just 28% of U.S. working families were considered “working poor”, but by 2011 nearly one-third of families fit that bill (two parents and two children, with household income less than $45,000 per year). Low-income working families account for more than one-quarter (26%) of all working families in Washington state, according to an analysis of 2011 data by the Working Poor Families Project.

From their report:

Although many people are returning to work, employment opportunities have been concentrated in the high-wage and low-wage sectors, with slower growth in jobs paying middle-class wages.

Some of the fastest-growing jobs during the recovery have included those in retail, food preparation, food service, health care, clerical jobs, and customer assistance. However, median hourly wages in these occupations are often not high enough to cover basic household expenses, even for families working full time.

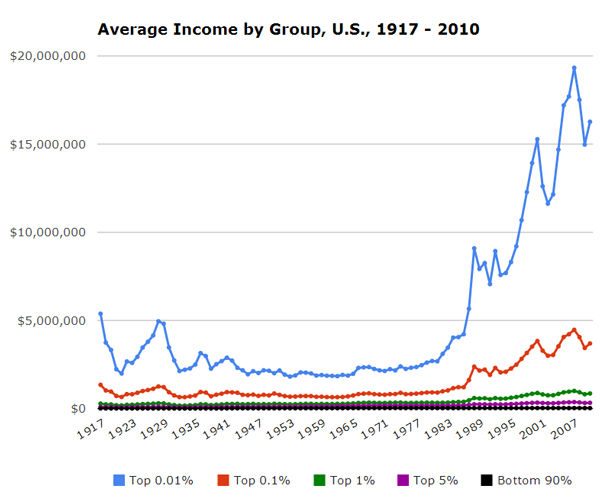

As we transition to a service-based economy, low-wage positions make up the largest number of jobs openings in Washington: retail salespersons, cashiers, and food service workers (including fast food workers). But despite massive gains in productivity across the workforce, the vast majority of income gains have gone to the top:

And that’s why working families are falling behind as they struggle to save for retirement, pay for health care, and balance work and family responsibilities.

More To Read

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits

January 29, 2025

Who is left out of the Paid Family and Medical Leave Act?

Strengthening job protections gives all workers time they need to care for themselves and their families

January 17, 2025

A look into the Department of Revenue’s Wealth Tax Study

A wealth tax can be reasonably and effectively implemented in Washington state