Washington’s next revenue forecast will lay out a stark choice for legislators: stick with a status quo that shortchanges residents — or take bold steps to solve the state’s chronic budget shortfalls.

When the state’s revenue forecast is released next week, legislators will turn much of their focus to hashing out Washington’s 2019-2021 budget. Given the state’s relatively strong economic growth, it’s very likely overall tax revenue will increase compared to last year. But given the state’s out-of-whack tax structure, extreme income inequality, and deep budget hole created by the Great Recession, it won’t be enough for legislators to fulfill the state’s existing commitments – much less address new or emerging public priorities.

Compared to the size of the economy, Washington’s tax code doesn’t generate the revenue it once did.

As shown below, throughout the 1980s and into the mid-1990s, policymakers were able to consistently reinvest the equivalent of about 6 percent of total state personal income in public services that helped communities and families up and down the economic ladder thrive. Since then, even as total income of state residents has soared, we’re reinvesting proportionately fewer dollars in our public structures and services than we did even as recently as 2008.

Budgets don’t start at $0 – and costs don’t stay flat.

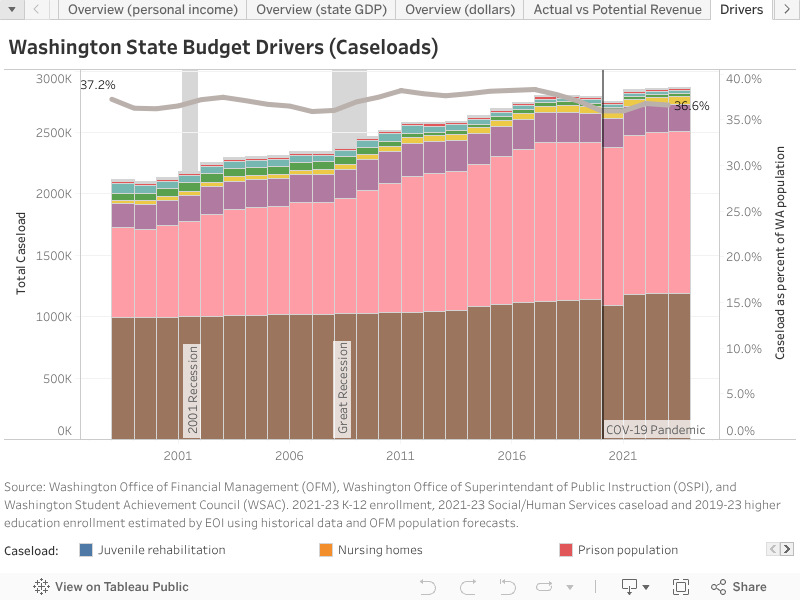

Demand increases as the state’s population grows: children go to school, elderly and vulnerable people need support services, young people enroll in college or learn a trade, and parks and other natural resources face increasing use. Washington’s population has grown by an average 1.6% per year since 1984 – adding more than 110,000 people per year since 2014. Due to inflation, the cost to the state for wages and products also goes up each year. And the nature and mix of the services themselves changes as public needs evolve.

Take medical assistance, for example. In the chart below, you can see it’s a larger and larger proportion of the yearly expenditures. As most Washingtonians know, health care is getting more expensive. But it’s not just more expensive for families and insurance-providing employers, it’s also more expensive for the state.

New policies are changing budget needs.

Per the terms of a recent legal settlement, the state has agreed to make sweeping upgrades to the state’s mental health system, and last year, legislators voted to implement a state-run health exchange for educators. In addition, school districts across the state are facing large funding shortfalls due to a local property tax cap legislators enacted in their 2018 funding package, designed to comply with the Supreme Court’s McCleary decision.

Public pressure is mounting on legislators to take action on a host of bread-and-butter economic issues.

Stagnant wages and growing income inequality (driven by lax corporate regulation, declining unionization and gaps in pay and opportunity by gender and race) mean that most working people and families – whether in Seattle, Longview, or Yakima – are finding it harder to cover the basics and get ahead. Even after adjusting for inflation, costs for rent or home ownership, health care, child care and higher education have outpaced modest increases in median family income.

Legislators can take steps to combat those trends, including by: investing in the state’s Housing Trust Fund to build new affordable homes throughout the state; funding Cascade Care to stabilize the individual health-insurance market and keep deductibles from rising; increasing subsidies for child-care providers, teachers and families to make child care more affordable; restoring investment in higher education to reduce tuition; and funding the working families tax rebate. But to do so, they’ll need to take real action to fix Washington’s broken tax code.

Meanwhile, the rich are getting richer and aren’t contributing much to the common good.

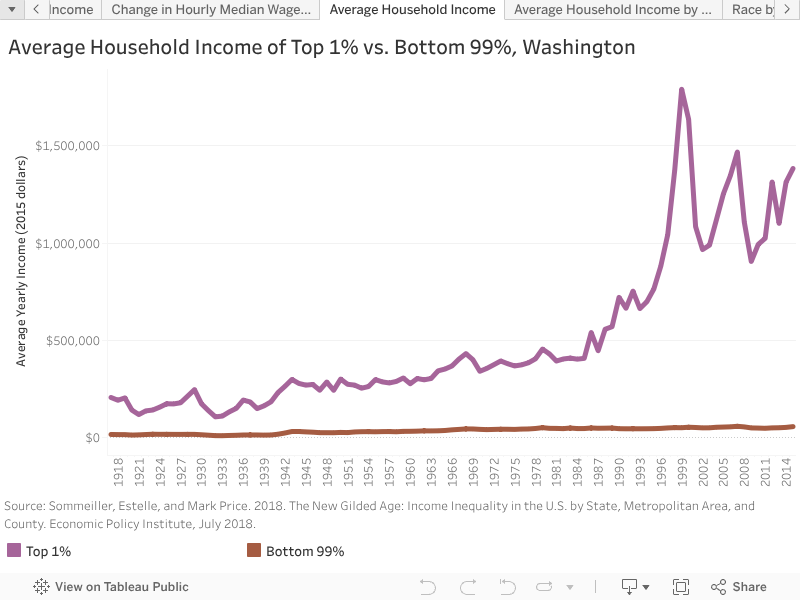

While on average, the state has higher personal income and more wealth than ever, growing economic inequality means most Washingtonians haven’t seen meaningful pay increases in decades. The top 1 percent has, to put it bluntly, raked it in – while wages have barely budged for most workers.

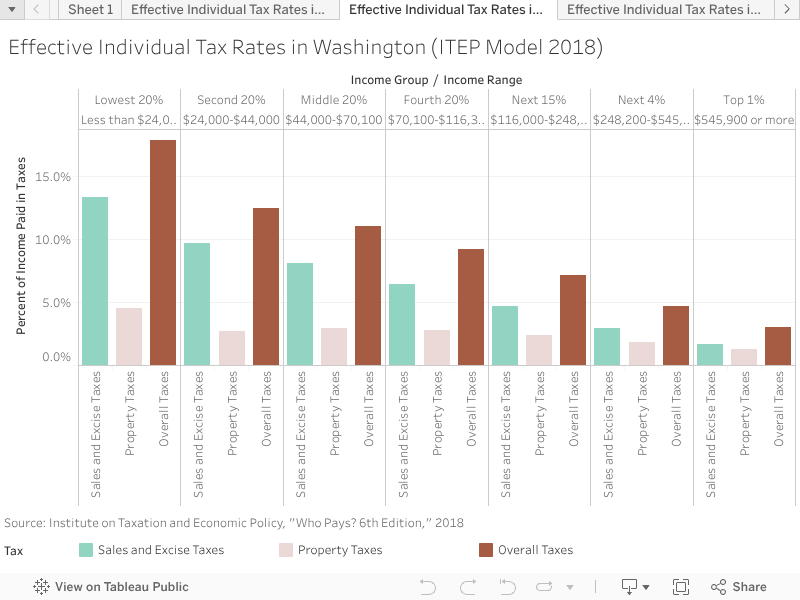

At the same time, our state’s existing tax code relies too heavily on sales and property taxes for revenue. That gives Washington the dubious distinction of having the most upside-down tax system in the country: low-wage earners – a disproportionate share of whom are people of color – pay nearly 18 percent of their income in taxes, while the top 1 percent, who are disproportionately white, pay just 3 percent of their income in taxes.

How legislators can start to fix Washington’s broken status quo

As daunting as all of the above may sound, there is actually a workable way forward. Legislators face a choice: increase revenue to enact a budget that meets public needs – or fail to fix the funding gap and leave those needs unmet. It really is that simple. Anyone who says “spending more wisely” will be enough to fill the gap is telling you we can have something for nothing – and hoping you are none the wiser.

Governor Inslee has proposed increasing the business and occupation tax rate on services and other activities to raise an additional $2.6 billion over the next biennium, changing the Real Estate Excise Tax from flat to progressive to raise $400 million, and moving forward with a capital gains tax on the sale of stocks and bonds and the like, which would affect only the wealthiest 1.5% of households yet generate nearly $1 billion annually.

Legislators should enact those proposals – and go further, by passing the following measures in order to generate more revenue to invest in the common good:

- Close special-interest tax breaks that drain public dollars before the budget is even written. Over the decades, lobbyists have quietly managed to get legislators to put nearly 700 tax exemptions on the books. Some are relatively small – but still ludicrous – like tax breaks on precious metal dealers. Others, like a tax break for investment management services – have a bigger impact. Together, they add up to an estimated $30 billion in potential revenue in the current 2017-19 budget.

- Add accountability. In addition to closing the most egregious tax loopholes in 2019, legislators should enact legislation that automatically sunsets 20 percent of the state’s tax breaks every two years – and they should renew only those exemptions they expressly include in future budgets.

- Double the estate tax. The Trump tax cuts slashed the number of estates subject to the federal estate tax – but Washington has its own estate tax. Doubling it would generate about $165 million per year and affect just 400 of the wealthiest estates annually – less than 1 percent of the total.

- Tax excess executive compensation. CEO and other top executive pay just keeps going up and up, while the typical employee sees little if any gain. A 10 percent Business and Occupation surtax on public corporations with a CEO receiving pay in excess of 50 times median income, and a 25 percent tax on ratios exceeding 150, would generate approximately $120 million in annual revenue. Alternatively, an excise tax paid by employers on excess compensation could also generate significant annual revenue. A 1 percent excise tax on compensation in excess of $250,000 would raise $100 million annually; a more progressive rate structure could generate as much as $400 million.

Choosing a better future for Washington

We all want to live in a prosperous state with thriving communities. The taxes we pay provide services today and build the foundation for a prosperous future with thriving communities.

Defenders of the broken status quo will cloak their opposition to these changes in broad language about “tax increases that hurt working families,” or talk only about the total revenue being raised, as if every resident would pay more.

Raising existing taxes that already fall too hard on working families – or doing nothing at all and failing to raise sufficient revenue – will only deepen existing economic and racial inequities, and leave the state without the resources to fulfill its public obligations – hurting hundreds of thousands of working- and middle-class families.

This year, our elected leaders must make a better choice for everyone’s future, by ending special interest tax breaks and ensuring the wealthiest have tax rates closer to those already paid by the middle class.

More To Read

January 6, 2025

Initiative Measure 1 offers proven policies to fix Burien’s flawed minimum wage law

The city's current minimum wage ordinance gives with one hand while taking back with the other — but Initiative Measure 1 would fix that

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 6, 2024

Tax loopholes for big tech are costing Washington families

Subsidies for big corporations in our tax code come at a cost for college students and their families

Andrea

How do we convince those who pay the most in taxes that the system isn’t working for them? It seems people think they will be the next to get rich so they will be in the chosen class. As long as I can remember I have heard people say Washington is blessed because it has no income tax. Simple math charts just don’t seem to change their minds.

Mar 16 2019 at 4:52 PM

David Ward

Excellent information, analysis, and proposed solutions.

Thank you. It’s much appreciated.

Mar 17 2019 at 2:38 PM