The recent tepid jobs report is a reminder that as a country we still have work to do to ensure future prosperity. But as we look to rebuild our economy and strive for growth in GDP, Robert Kennedy’s famous words from 1968 should ring in our ears:

Gross National Product counts air pollution and cigarette advertising, and ambulances to clear our highways of carnage. It counts special locks for our doors and the jails for the people who break them. It counts the destruction of the redwood and the loss of our natural wonder in chaotic sprawl. It counts napalm and counts nuclear warheads and armored cars for the police to fight the riots in our cities. It counts Whitman’s rifle and Speck’s knife, and the television programs which glorify violence in order to sell toys to our children.

It’s been 44 years since Kennedy first called us to reconsider the meaning of GDP, and since then we have experienced near uninterrupted economic growth. But what have we gained? Does growth equal progress? Consider this:

- Today 15% of Americans live below the poverty line—the same as when Kennedy gave his speech.

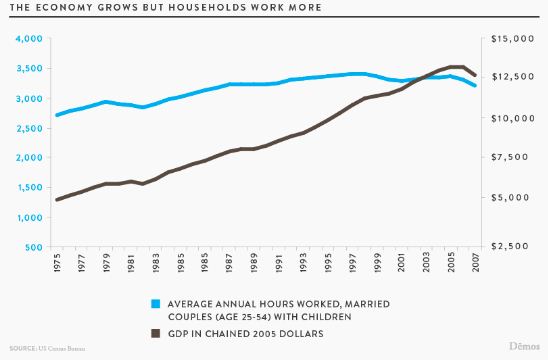

- While GDP per capita has more than doubled the past 30 years, median individual income has barely moved. Growth comes not from wage increases, but from families working more hours than they ever have before.

- What has grown? Incarceration, inequality, household debt and carbon emissions have all increased at pace or faster than the standard measure of our nation’s economic health.

You can see these trends and more in a new slideshow from D?mos that reinvigorates the debate over what progress really means for America.

And to find out how Washington’s economy is doing – beyond just the dollars and cents – check out the State of Working Washington, where we track earning disparities, access to paid leave, employee benefits, health coverage, and much more.

By EOI intern Ashwin Warrior

More To Read

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits

January 29, 2025

Who is left out of the Paid Family and Medical Leave Act?

Strengthening job protections gives all workers time they need to care for themselves and their families

January 17, 2025

A look into the Department of Revenue’s Wealth Tax Study

A wealth tax can be reasonably and effectively implemented in Washington state