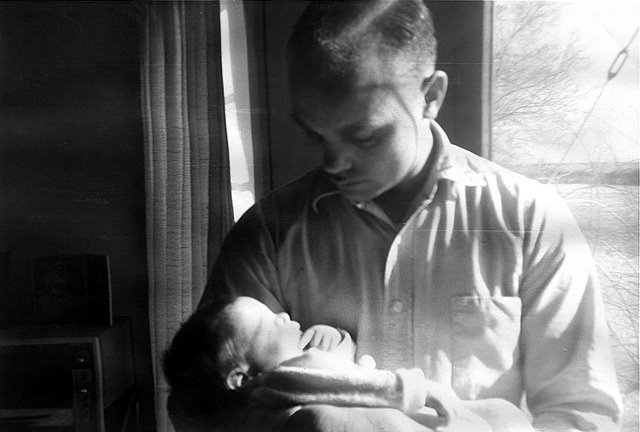

Photo: mckinney75402 via Flickr Creative Commons

In the decade since Washington state’s House Appropriations Committee last heard a paid family leave bill, we’ve learned a lot about how the first year of life sets the foundation for lifelong health and well-being, how our aging population and the gender wage gap affect our whole economy, and about the positive outcomes – and shortcomings – of established programs in other states.

That research, along with the input of community members and business owners from across the state, is incorporated in the legislation they are now considering.

For decades, California, New Jersey, New York and Rhode Island have provided universal statewide disability insurance programs, including maternity disability leave, covering workers in every type and size business. Details vary, with maximum leaves ranging from 26 to 52 weeks and different levels of benefits. All are financed through payroll premiums, jointly paid by employers and employees in New York and New Jersey, paid fully by workers in the other two.

In the past dozen years, all 4 states have added an additional allocation of family leave.

In these states, new parents take longer leaves than in other states, new moms and babies are healthier, women are more likely to be working and for higher wages a year following childbirth, and fewer new parents rely on public assistance. We also have learned that when benefits are too low, low and middle income workers are still forced by family finances to return to work too soon for the best health outcomes.

House Bill 1116 is modeled on these programs, designed to produce the best outcomes for our state.

Employers and employees would each pay into a trust fund administered by Employment Security. When fully implemented, a median wage worker would pay $2 per week, matched by the employer. For a firm with a $500,000 annual payroll, that would add up to about $100 per month.

Benefits are progressive, in order to be as accessible to someone, say, in Rep. Pettigrew or Manweller’s district as someone in Rep. Pollet’s. Someone making up to about $550 a week would get 90% wage replacement, someone making $1,000 would get 72%, and you’d hit the $1,000 weekly maximum at about $1,600 in weekly wages.

Since employees would be paid out of the trust fund when they needed an extended leave, the employer would have the employee’s usual wages to add hours or hire a temporary replacement to cover the work.

Administrative costs as well as benefits will be paid for out of the trust fund. The direct cost to the state is as an employer for its share of premiums. The numbers in the fiscal note for both state and local school district costs represent 100% of the premium cost, both the employee and employer share.

We’ve heard so much compelling testimony from individuals and from small business owners who are eager to be able to provide this new benefit to their employees – and like the predictability this shared insurance model provides.

I urge members of the committee to pass HB 1116.

(Excerpted from testimony to the Washington State House of Representatives Appropriations Committee, 2/9/17)

More To Read

July 19, 2024

What do Washingtonians really think about taxes?

Most people understand that the rich need to pay their share

June 5, 2024

How Washington’s Paid Leave Benefits Queer and BIPOC Families

Under PFML, Chosen Family is Family

May 24, 2024

Why Seattle’s City Council is Considering Delivering Poverty Wages to Gig Workers

Due to corporate pressure, Seattle’s new PayUp ordinance might be rolled back just 6 months after taking effect