At a time when people are increasingly worried about retirement – both their own and the retirement of their parents and grandparents – a new poll shows the vast majority of Americans support higher taxes to increase Social Security benefits.

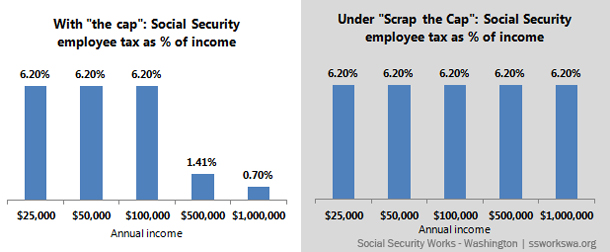

As we (and others) have been saying for years, Social Security’s problem is small and very manageable. If all Americans paid the same Social Security tax rate, the system would be financially sound for generations to come. But this year, Social Security taxes will only be levied on the first $113,700 of earnings – that’s “the cap” – and people earning over it don’t pay in on those earnings. Scrapping the cap would ensure all Americans contribute their fair share to Social Security, and preserve it for future generations.

Now, it seems the majority of Americans agree that higher taxes – and scrapping the cap – are the best way to shore up Social Security.

A poll commissioned by the National Academy of Social Insurance (NASI) asked people about a menu of options, from raising to retirement age, to cutting benefits, to increasing taxes. Here is the package of reforms supported by 71% of respondents:

- Gradually eliminate the cap on earnings ($113,700 in 2013).

- Gradually raise the payroll tax rate on both employers and workers from 6.2% to 7.2%.

- Bolster a special minimum benefit intended to keep very low-income workers out of poverty.

- Set Social Security’s annual inflation increase, using a measure of consumer prices that accurately reflects the higher prices older people pay for healthcare – effectively, the opposite of a chained CPI.

- Keep Social Security’s full retirement age at 67, and do not means test the program.

Some find it surprising that so many people are willing to sacrifice a bit more to ensure Social Security will be there for their parents, children, and themselves – but perhaps they shouldn’t. Just 14% of Americans report having enough money to live comfortably in retirement, and barely 2 in 5 private-sector workers between 25 and 64 have a employer-sponsored retirement plan of any sort.

Of course, not ALL Americans love Social Security. Remember that the Business Roundtable, representing 200 of America’s most influential and wealthy CEOs, proposed a plan to raise the retirement age to 70 and cut benefits via the chained CPI.

Perhaps this poll will be the impetus needed to swing politicians and journalists away from their fear-mongering about Social Security.

More To Read

September 10, 2024

Big Corporations Merge. Patients Pay The Bill

An old story with predictable results.

September 6, 2024

Tax Loopholes for Big Tech Are Costing Washington Families

Subsidies for big corporations in our tax code come at a cost for college students and their families

July 31, 2024

News from the Road: EOI’s summer policy road trip continues

We're working to understand the issues that matter to Washingtonians