Last year, Arizona-native and hedge fund manager Brian Heywood used his spare, untaxed cash reserves to launch six initiatives. The subject represent a wide range of social and fiscal issues. All six, though, have the same goals: To roll back, curtail, or prevent progressive policies.

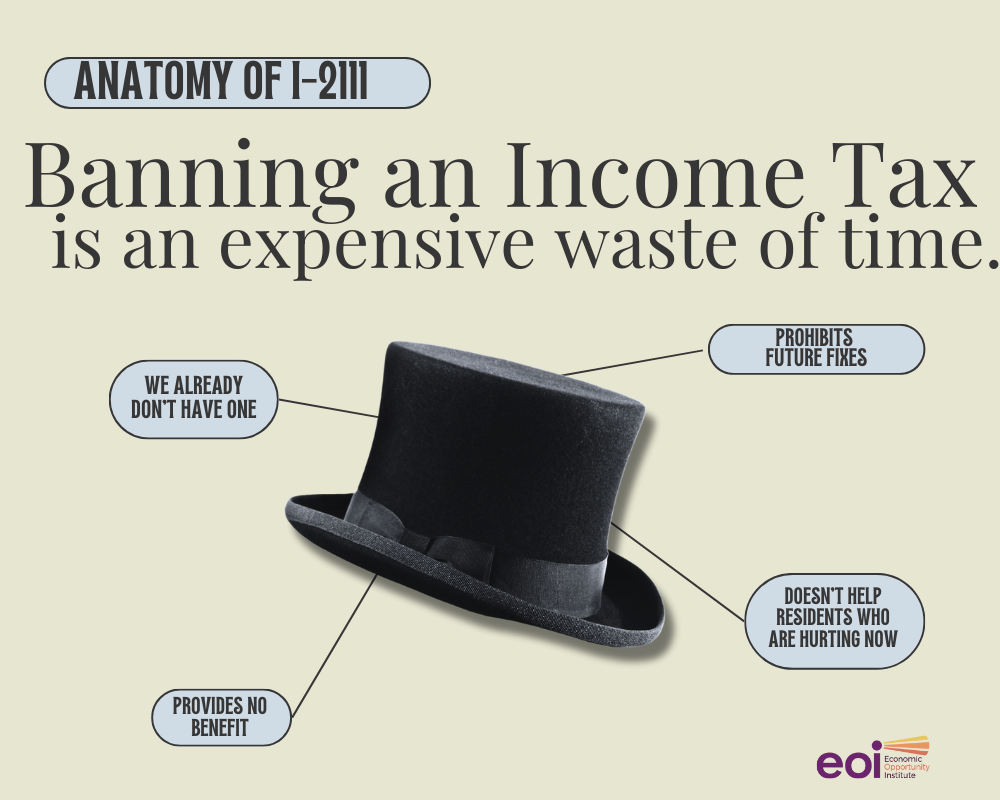

Three are set to go to the ballot, while another three were passed fairly unceremoniously by the legislature late in the 2024 session. Importantly, I-2111, which would prohibit local and state government from introducing any taxes on personal income, was among those that were passed in the Legislature.

This, of course, seems strange. Why would a legislature with a Democratic majority under a Democratic governor choose to pass a law that could potentially set back decades of attempts to fix Washington’s deeply broken tax policy?

The answers are a bit complicated and, at this point, what’s done is done. However, it’s important that we look at why Washington lawmakers were so quick to pass this ballot initiative – and what it means for future conversations around sorely-needed tax reform.

What Happened with I-2111?

The rationale for passing the three was somewhat murky. Democratic lawmakers who voted in favor saw it as a way to circumvent a risky ballot run on three initiatives that might win in November. This would, they argued, prevent any greater political damage.

Whether or not the actual policy changes anything is yet to be determined – legal experts and lawmakers alike have emphatically stated that there is no material impact from I-2111. Banning an income tax in a state that already doesn’t have an income tax isn’t going to immediately drain the funds.

Unfortunately, as the hearings and the subsequent conversation made clear, the real harm doesn’t necessarily come from the initiatives themselves. Actual changes to the law weren’t necessarily the goal. Instead, it’s clear that there’s already been a chilling effect on any momentum toward demonstrable improvements for working people.

Heywood and his millions have effectively bought a way to change the entire conversation. Instead of fighting for progressive taxes, those of us who want to find a real solution to Washington’s revenue problems are litigating tax policy on the terms of the very rich once again.

But before getting into the broader conversation, let’s talk about why the income tax has millionaires so upset.

What Would An Income Tax Do for Washington?

Income taxes, at their core, ensure that everyone pay taxes that are commensurate to their earnings. This means that they are more fair – less regressive – than other forms of taxes. But how would that potentially shift Washington’s tax system?

To understand the impact, we have to consider the way that income taxes work in states that have them. Washington is one of just nine states that don’t tax income. It’s also the state with the second most regressive tax structure in the nation. And it’s no coincidence that of the eight other states that don’t tax income – Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Wyoming – all but three are at the bottom of the regressivity list.

Currently, Washington’s current tax system is disproportionately reliant on sales tax and property taxes. That structure benefits the ultra-wealthy; they pay very little. That’s because the bulk of their income doesn’t come from a regular paycheck; instead, they get paid when their money makes even more money.

I-2111: Banning Something We Don’t Have

Put more simply, it’s clear that an income tax can be a huge equalizing factor. It can be a way to make tax collection more equitable. And it goes without saying – or maybe it doesn’t – that striving toward more equitable tax collection is what Washington needs to do.

An income tax is feasible solution for Washington, according to the experts. The Tax Structure Work Group, a bi-partisan work group dedicating to studying our tax code and making recommendations, wrote the following:

In comparison to the sales tax, a graduated PIT [Personal Income Tax] that increases with household income could produce a sizable decrease in household tax burden for lower-income households depending on the tax rate used.

Meanwhile, the existing sales tax sets up our public revenue system for an ongoing, structural deficit. There’s ample research showing that sales tax collections do not track with the growth in state personal income. Wealthier people don’t spend a proportionate amount to their income. At the same time, everyone else pays more of their income into a sales tax that’s both burdensome and ineffective. Because balancing the budget on the lowest earners necessarily doesn’t bring in enough revenue.

Facing Washington’s Revenue Problem

So why would anyone want to ban something that could potentially make Washington’s tax structure more fair? Or provide ample funding for public programs and services, and address the racial inequities in our tax code? Or help build up our infrastructure in the face of climate change and extreme weather?

The answer is simple: Greed. An income tax would require the ultra-rich to pay much more of their wealth back into the system. Which is why they fight it at every turn. And unfortunately, many voters fall for their statements that keeping taxes low for the rich somehow benefits everyone.

We know that our current tax structure, balanced heavily on sales and property taxes, place a burden on middle-income families. Increasing revenue from top earners, then, could open the door to conversations about reducing the sales tax or creating property tax credits for homeowners.

If increased tax collection from the wealthy alone meant Washington could balance the budget, then there might be room to discuss reducing the burden on the folks who have been carrying the weight for so long. But it’s nearly impossible to have those conversations without realistic recommendations for replacing revenue.

From Offense to Defense

That’s how we ended up in this situation. It seems that the goal of many Let’s Go Washington and I-2111 backers isn’t about changing policy. Instead, it’s more about creating a hostile environment for tax reform.

Because passing a ban on something we don’t have doesn’t change our material reality – but it does shift the political conversation. Instead of talking about legislation to shore up our tax structure, Let’s Go Washington and I-2111 dominated the conversation, particularly at the end of the session. This session, we couldn’t spend time brainstorming solutions or working toward a tested, proven method (like a wealth tax). Instead, lawmakers, advocates, allies, and local leaders were forced to waste time, energy, and money having a conversation that’s mostly theoretical.

This is part of the plan. Heywood and his ilk can use their stockpiles of cash to undermine years of legislative work by threatening something so basic as a potential new method of revenue collection.

This is a tragedy for the Legislature and for Washington residents.

“In these times of so much unnecessary suffering, so much anxiety and uncertainty that so many families are carrying about their future and their children’s future, the conversations our lawmakers are spending time on is, ‘how can we maintain this current system?’” stated Economic Opportunity Institute’s Carolyn Brotherton.

“Ultimately, the rich and powerful keep winning in this scenario while the rest of us wonder why nothing changes.”

We Won’t Quit

Nothing is likely to change, at least not for the better and not without some serious organizing. While banning something that doesn’t yet exist in Washington law doesn’t impact the ability to raise revenue, it shifts the conversation on taxes. It creates new legitimacy for right wing, anti-tax, antigovernment efforts. And it feeds the news media with stories not about the people who need help, but the people who are spending money to keep their money.

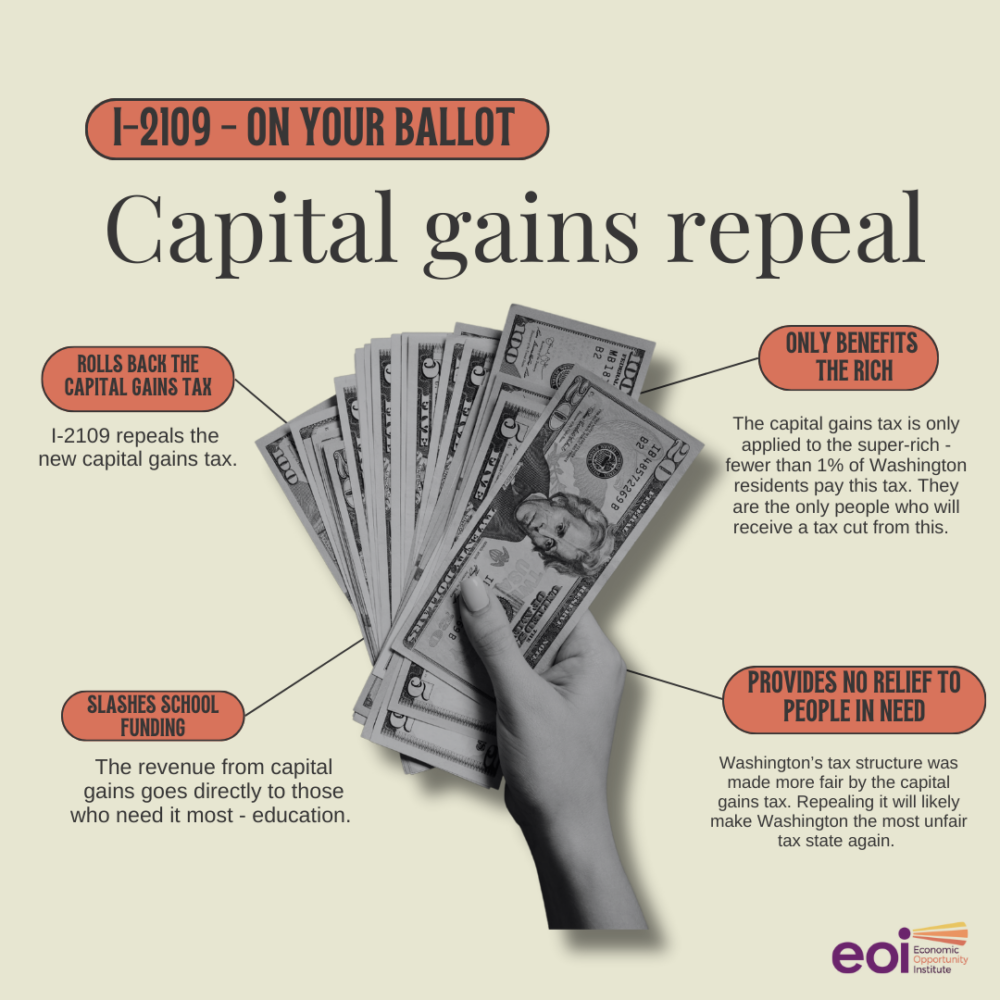

Instead of fixing the problem that everyone knows needs to be fixed, those in favor of a more equitable tax structure have been forced to defend what we already have, like the new capital gains tax, which could be repealed in November.

The capital gains tax has raised close to $1B in its first year of collection. The revenue provides massive benefits to families across Washington. And the only people paying it? The ultra-wealthy. Repealing it, then, won’t offer any relief to working Washingtonians. Instead, it’ll create a massive deficit in education funding – and give a tax break for the people who need it the least.

Regardless of what happens in November, though, the Legislature is going to have its work cut out for it. Because even after Let’s Go Washington derailed the conversation, we won’t stop working toward a more equitable tax system.

Having passed I-2111 in the session, lawmakers are now in a situation where they must take action, both in the interim and next session. Constituents are going to want to know whether or not they’re allowing some ultra-rich man to buy new laws – and what they can expect from their taxes (and increasingly underfunded services and programs) in the years to come. If they choose to strike or amend the income tax ban – which they can – they might be positioned to pivot and actually fix the tax code.

But that’s a big “if,” and one that we’ll be watching closely for the next 10 months.

More To Read

January 6, 2025

Initiative Measure 1 offers proven policies to fix Burien’s flawed minimum wage law

The city's current minimum wage ordinance gives with one hand while taking back with the other — but Initiative Measure 1 would fix that

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 6, 2024

Tax loopholes for big tech are costing Washington families

Subsidies for big corporations in our tax code come at a cost for college students and their families

Lisa Wellman

Passing the 3 initiatives gives the Legislature the ability to amend them – these 3 badly written but somewhat ambiguous initiatives can be amended like any other bills that pass. Had they not been passed by the Legislature but passed on the ballot, they could not be amended for two years.

Mar 24 2024 at 7:52 PM