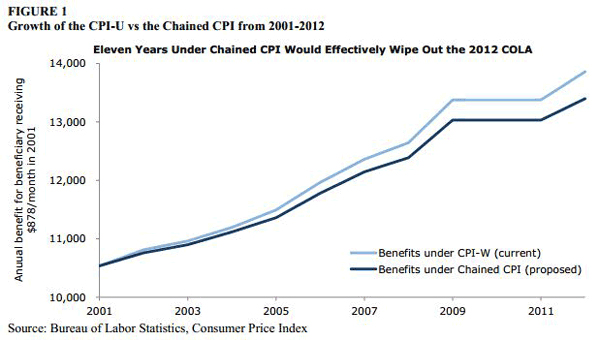

The Center for Economic Policy Research (CEPR) has published a brief on one of the proposed changes to Social Security under the “fiscal cliff” deal – this one known as the “Chained CPI.” The Chained CPI is a bit complex, but here’s the bottom line: it would cut benefits for Social Security recipients by shrinking annual cost-of-living adjustments.

CEPR calculates that it would equal a 3% benefit cut over 10 years, a 6% benefit cut over 20 years, and 9% after 30 years. For the average worker retiring at age 65, this would mean a cut of about $650 each year by age 75 and a cut of roughly $1,130 each year at age 85. This is especially significant given 3-out-of-5 seniors rely on Social Security for more than half of their income.

Some argue the Chained CPI is a more accurate calculation of inflation, but this is not the case for seniors. As we reported in an earlier post, seniors tend to spend more money on health insurance, hospitals, prescription drugs, and nursing care – expenses that are not taken into account by the current CPI calculation. The Bureau of Labor Statistics, which manages the CPI indices, has created an experimental index called the CPI-Elderly, which more accurately reflects the costs faced by seniors. The CPI-Elderly shows a rate of inflation about 0.3% higher than the current CPI calculation.

CEPR also reports the Chained CPI amounts to a stealth tax increase on all Americans, but especially those at middle and lower incomes: “For example, workers with incomes between $10,000 and $20,000 would experience an increased tax burden of 14.5 percent, while those with incomes over $1,000,000 would just see an increase of 0.1 percent.”

Read more from The Chained CPI: A Painful Cut in Social Security Benefits and a Stealth Tax Hike

More To Read

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 10, 2024

Big Corporations Merge. Patients Pay The Bill

An old story with predictable results.

September 6, 2024

Tax Loopholes for Big Tech Are Costing Washington Families

Subsidies for big corporations in our tax code come at a cost for college students and their families