The land of higher education teeters on the brink, as a winter of student debt threatens to sweep down upon it from a white wall of loans. Yet hope endures, for a “Stark” contrast has emerged: Pay It Forward.

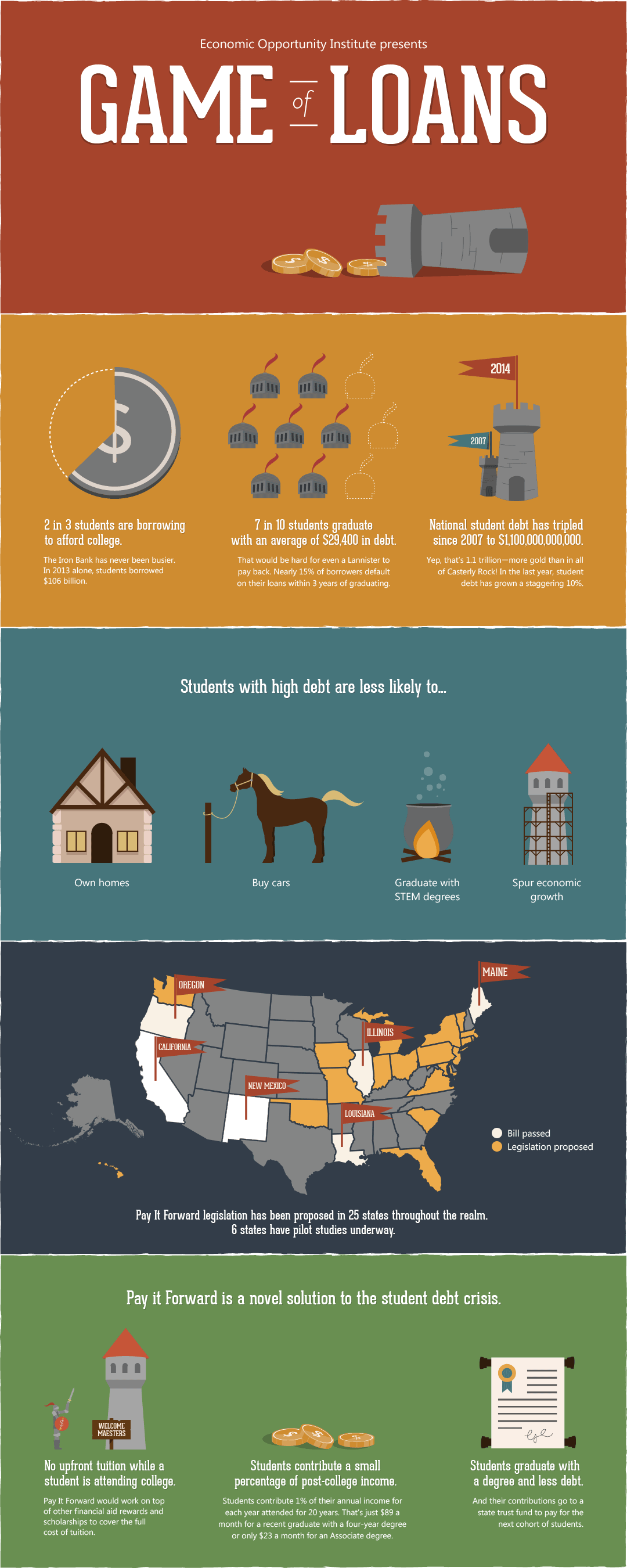

Today, 7 in 10 students are graduating with an average $29,400 in debt, making them less likely to own homes, buy cars, graduate with a STEM degree, and spur economic growth.

EOI’s Pay It Forward plan offers no upfront tuition while attending college – instead, students contribute a small percentage of post-college income, so they graduate with a degree and less debt.

It would work on top of other financial aid rewards and scholarships to cover the full cost of tuition. Students contribute 1% of their annual income for each year of college attendance, for 20 years. That’s just $89 a month for an recent graduate with a Bachelor’s degree, or $23 a month for someone with an Associate degree. And the contributions go to a state trust fund to pay for the next cohort of students.

More To Read

October 14, 2025

Opportunity for many is out of reach

New data shows racial earnings gap worsens in Washington

May 19, 2025

A year of reflections, a path forward

Read EOI Executive Director's 2025 Changemaker Dinner speech

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House