Last week, the 2024 legislative session came to a close – but not before lawmakers passed a bill that provides new protections against wage discrimination. The timing of the bill couldn’t be better; Women’s Equal Pay Day falls on March 12 and begins a year-long recognition of the persistent pay gaps that women experience every day.

Women’s Equal Pay Day symbolizes the gender wage gap between men and women in the United States. Its placement in March symbolizes how far into the year a woman must work to earn what her white male peer would have earned. According to the Institute for Women’s Policy Research, in 2022, women who work full-time, year-round, are paid 84 cents for every dollar paid to a man.

This translates to nearly $10,000 less for women working full-time, year-round.

Imagine the impact $10,000 could have on a woman’s financial stability if she is the primary caretaker and breadwinner in her home. Consider the lost wages over decades – over generations – that are represented by this figure.

Washington women face a wider wage gap

According to the National Women’s Law Center, Washington women experience a higher-than-average pay disparity. Here, a full-time, year-round working woman earns only 82 cents for every dollar a man earns.

But this number doesn’t tell the entire story. We know from decades of data that women are at higher risk of experiencing wage discrimination when they identify with more than one marginalized group.

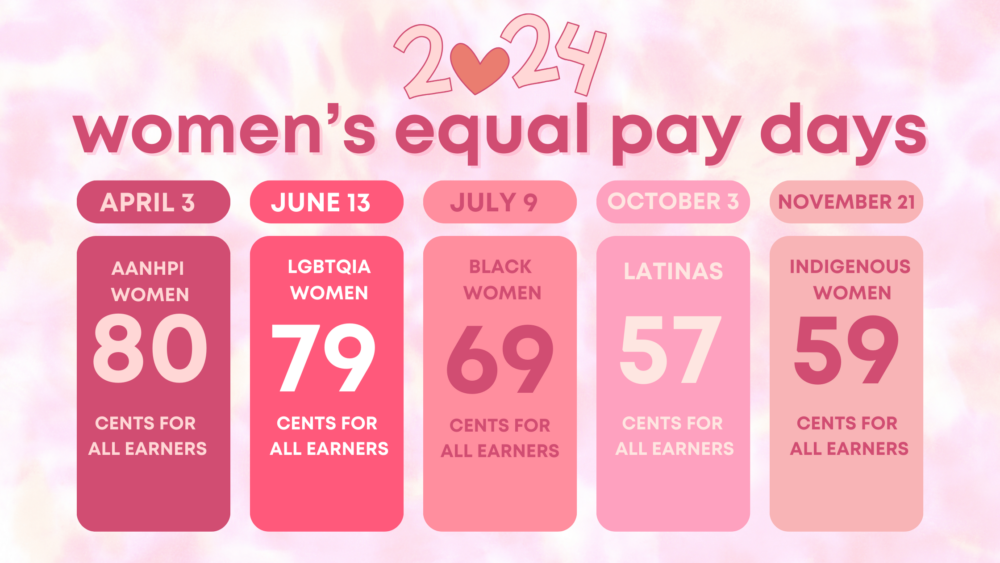

Indigenous Women working year-round in a full-time job will earn only 59 cents to every dollar white men make. Latina and African American Women will earn 57 cents and 69 cents, respectively.

Which bring us to the law that Washington state passed (HB1905) this session.

Paying respect to progress in Washington

This bill acknowledges women’s diversity – and the need to address wage gaps and discrimination with an intersectional lens. HB 1905 amends the Washington Equal Pay and Opportunities Act to extend protections against wage discrimination to our state’s workers based on a wider variety of identities. Those include: age, sex, marital status, sexual orientation, race, creed, color, national origin, citizenship, immigration status, honorably discharged veterans, military status, or the presence of any sensory, mental or physical disability or the use of a service animal.

It’s not surprising that, as a state, Washington is leading the way on pay equity. The Washington Equal Pay Act, enacted in 1943, was one of the first of its kind in the nation. When it was first passed into law, it was designed specifically to address income disparities, employer discrimination, and retaliation practices for working women.

Since then, the Equal Pay Act has been strengthened and expanded. The first change came in 2018, when an amendment gave the law greater enforcement capabilities . In 2019, it was further expanded to prohibit an employer from seeking an applicant’s wage or salary history. Then, in 2022, an additional amendment was added, requiring employers to disclose wage and salary information in job postings for each job opening.

HB 1905, then, is part of a long history of adding to policies when changes are needed. This, combined with the previous changes, make Washington’s equal pay laws some of the most comprehensive anti-discrimination rules in the country.

And yet, a wage gap still persists – both here and across the country.

States do what the Federal Government won’t

A lack of movement from congress has forced states to step up. The Federal Equal Pay Act of 1963 has not been updated since it was enacted. Other rules, like Title VII of the Civil Rights Act of 1964, are in desperate need of an update; other protected classes, such as marital status, sexual orientation, or honorably discharged veterans, aren’t covered under Title VII.

This is why state-level bills are so important.

Many individual states have passed their own laws to fight wage disparities, but only a few offer protections to other protected classes besides gender. California’s protections include gender, race, and ethnicity. Illinois covers gender and specifically calls out African American workers. Iowa, New York, Oregon, and New Jersey have the most expansive laws because they include age, race, creed, color, gender identity, national origin, religion, or disability, among other classes.

This has created substantial differences in working conditions across the country. Equal pay opportunities for workers in underrepresented classes should not be dependent on state lines. Congress must step up and update the Equal Pay Act. Until our federal government sets the tone, many others will not follow.

How Equal Pay Day became Equal Pay Days

Though congress may move at a snail’s pace, champions for wage parity are much quicker to adapt. Consider how different our perspective is now, compared to the first Women’s Equal Pay Day in 1996.

At that time, the gender wage gap was a rarely-acknowledged reality of working life. Nuance like race, sexual orientation, or gender identity weren’t part of the equation. Statistics and data failed to take into account the real experiences of single moms, or moms with disabilities, or immigrants.

Over the years, though, we’ve expanded our understanding of the collective economy of working women. We’ve acknowledged that women are not a monolith. Women are also queer, are immigrants, are trans, are veterans, or have a disability.

We have all grown and changed since 1996. Unfortunately, federal protections have not kept pace. But with every year – and every policy lawmakers on the state level pass – we grow one step closer to parity.

More To Read

January 6, 2025

Initiative Measure 1 offers proven policies to fix Burien’s flawed minimum wage law

The city's current minimum wage ordinance gives with one hand while taking back with the other — but Initiative Measure 1 would fix that

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 6, 2024

Tax loopholes for big tech are costing Washington families

Subsidies for big corporations in our tax code come at a cost for college students and their families