Cheerleaders of “prosperity” have treated the economic boom in Seattle like sports fans. When the Seahawks won the Super Bowl in 2014, crowds filled the streets chanting, “We did it!” While the people in the street didn’t literally touch the ball or score a touchdown, they felt like they had accomplished something. Seattle’s growth is largely the same. Venture capitalists and their ilk cheer Seattle’s population and tech boom like the whole city is winning something. We’re encouraged to feel like we’re getting richer because they are.

But having rich neighbors doesn’t make you richer. In fact, it may make you poorer.

When Amazon announced this month that it was looking to build a second headquarters with 50,000 employees in another city, Seattle went into a tizzy. During his five days in office, Mayor Bruce Harrell issued an executive order instructing Seattle to bid on HQ2, worrying that losing the second headquarters would be a disaster for Seattle’s economy.

But they often ignore that the recent economic boom in Seattle has had some very negative effects for the people who live here. Property taxes have gone up 35 percent, home prices have doubled, rent has increased 57 percent, traffic is stifling, homelessness has doubled, black people are being pushed out of the city, and violent crime increases every year.

The negative effects of the growth are easy to overlook because unemployment is down and everyone is supposedly making more money. But that’s a ruse. That growth hasn’t necessarily helped long-term residents of Seattle in terms of unemployment, and a lot of them aren’t making more money.

Unemployment in Seattle is now at 3.3 percent, below the national average of 4.5 percent. In fact, it’s been a few points below the national average for over a decade. Does that mean people who’ve lived here for decades are having easier times finding jobs? Not necessarily, when the tech companies responsible for the hiring boom are bringing their employees in from outside the city.

Imagine Seattle’s employment situation like a bowl of marbles – half yellow, half red. You add in a handful of yellow marbles. The percentage of red marbles have gone way down. But does that mean there are fewer red marbles? No.

Amazon alone has increased its workforce in Seattle by 35,000 people since 2010. The population of Seattle has increased by 90,000 people since 2010. These are yellow marbles in our bowl. If you are not a tech worker, the hiring boom in Seattle does not mean it’s easier for you to find a job.

Income in general has also increased in Seattle. In fact, median household income shot up from about $70,000 in 2014 to about $80,000 in 2015. That’s in just one year! But again, it doesn’t mean everyone is doing better. An influx of higher-income earners can skew the median, making it rise without improving the lot of the people already here. The computer programmers Amazon and other tech companies recruit earn about $120,000 per year.

Think of it like this: Imagine that you live on a street with a few other middle-class families. As a group, these households have an average wealth of about $100,000. But then Amazon CEO Jeff Bezos builds a new (big!) house on the block and moves in. Now the average wealth for the group is $8 billion! But did anyone actually get richer? (Granted, this is mean, which is generally easier to move than median, but it’s better for an analogy! Plus, when you add so many people every year, the median is more flexible than normal.)

The income trends make it clear: only the well-educated are really doing better. People with graduate degrees are making about $10,000 more a year than they did 12 years ago. People with bachelor’s degrees are making about $5,000 more. (And that’s after adjusting for inflation.) But those with associate’s degrees or a high school diploma are actually making a couple thousand dollars less. Wages for people who did not graduate high school are about that same – but only because they’ve been bolstered by minimum wage increases in the last few years.

Seattle’s newfound wealth is not being spread around. Amazon offers extremely competitive wages to programmers – and run-of-the-mill wages to the people who serve and clean up after them. Skyrocketing living expenses and no real increase in wages mean people at lower income levels have no reason to stay in the city, if they could even afford to.

This creates problems for our community. For example, Seattle now has about 2,500 restaurants, 500 more than a decade ago. In theory, more people can now take jobs as cooks thanks to that increase. In reality, not enough people are willing to do that. While Seattle is a lovely place to live, it’s not lovely enough to move here for pay that might cover your rent, but leave you no money for food. And our regressive sales- and property-based taxes means that people who make $20,000 pay 16.8 percent of their income in state and local taxes, while people who make $200,000 pay 4.6 percent.

Seattle is becoming top-heavy, and it’s unsustainable.

The idea of growth as a purpose and end in itself has become cancerous. Long-term Seattleites are starting to wake up to this. Only 43 percent of long-term residents think Seattle is headed in the right direction, compared with 65 percent of newcomers, according to a recent poll. And only half of long-term residents think the recent growth is good, although three-quarters of the newcomers do.

Progressive taxes are part of a fair solution

To create a livable city for everyone – not just the top – Seattle needs a variety of improvements. It requires affordable housing, services for the homeless, better public transportation, and improved public schools. But Seattle doesn’t have the resources necessary to catch up to all this growth, let alone make the changes and improvements our neighborhoods need to accommodate the projected 38 percent increase in population by 2040.

Sales tax revenue was sufficient when our economy was based largely on the consumption of goods – actual tangible things. But an increasing share of our growth is in services, which are largely untaxed, leaving public revenue (and public investments) lagging.

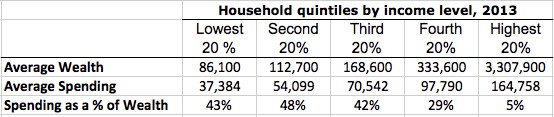

Even if tax revenues did keep up under the current system, rich people wouldn’t be paying a fair share. Believe it or not, having richer people in Seattle doesn’t yield a proportional increase in tax revenue. This is because people who have lots of money don’t spend it like everyone else. Here’s a national comparison of how much people spend versus their household wealth:

Sources: Federal Reserve’s Survey of Consumer Finance, Bureau of Labor Statistics’ Consumer Expenditure Survey, data crunched by Steve Roth.

This chart only shows gross wealth, not factoring in the huge amounts of debt that lower income households accumulate. In 2011, the Census Bureau estimated that the mean net worth of American households in the lowest quintile was $-32,066. That’s right. Way less than $0.

The money that the rich new people are bringing to Seattle isn’t spreading around the city – it’s sitting in their banks accounts and stock investments. The newly passed income tax on Seattle’s wealthiest households will help even the playing field, so the rich can’t hoard their money while everyone else picks up the tab.

Opponents to Seattle’s recently passed income tax on the wealthiest residents say it will stifle growth and opportunity for all people. But the economic benefits from Seattle’s growth haven’t been for everyone – only for the people moving here for the new tech jobs.

The planned income tax on the very wealthy will allow Seattle to expand thoughtfully, making sure the rich people moving here are paying their fair share to fund increased strain they put on city services. It will also allow the city to lower regressive sales and property taxes to make Seattle more affordable for lower- and middle-class households.

The very rich are cheering their newfound prosperity in Seattle. Let’s give everyone something to cheer about.

More To Read

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 6, 2024

Tax Loopholes for Big Tech Are Costing Washington Families

Subsidies for big corporations in our tax code come at a cost for college students and their families

July 19, 2024

What do Washingtonians really think about taxes?

Most people understand that the rich need to pay their share