With every paycheck, both workers and employers contribute to Social Security. When we reach retirement age – or face extenuating circumstances like a disability or the death of a breadwinner – we are protected by modest but dependable monthly benefits.

Nearly all of us are covered because nearly all of us contribute. But we don’t all contribute equally.

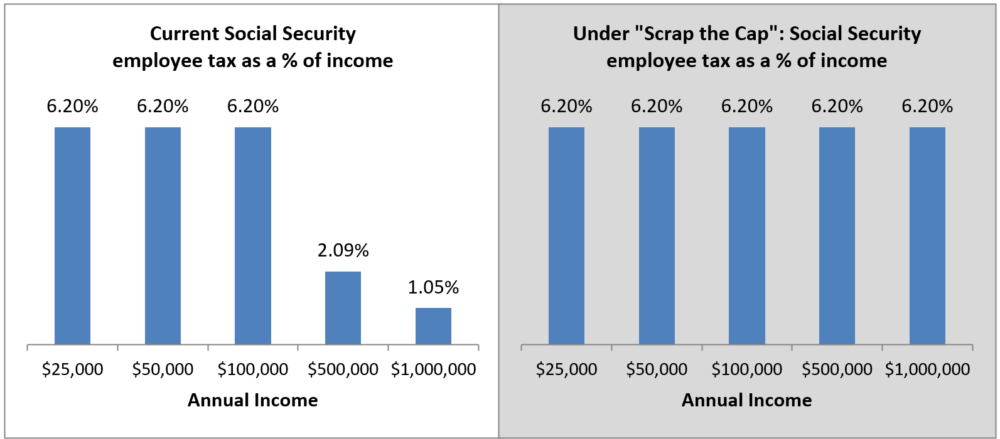

Social Security taxes are collected only on the first $168,200 of earnings this year. Additionally, those who receive investment income pay no Social Security tax on it at all. That means high earners and wealthy individuals – like CEOs and corporate shareholders – effectively pay a lower Social Security tax rate on their income.

This is the Social Security cap – and its time is up.

That tax ceiling – known as the “cap” – is inequitable and unfair. If we simply “Scrap the Cap” – get rid of the ceiling altogether – millionaires would pay the same tax rate as middle-class families. Doing so would not only make our economy more equitable; it would also dramatically improve Social Security’s long-term finances. We could also broadly increase Social Security benefits for all Americans – helping keep more seniors, children, and families out of poverty.

Social Security represents the best of American values: rewarding hard work, honoring our parents, and providing help for those unable to care for themselves. If we Scrap the Cap – instead of cutting earned benefits – we can protect Social Security for the future and expand benefits to those who need them.

This simple solution will ensure all Americans contribute their fair share to Social Security and help preserve it for future generations.

Enter the Social Security 2100 Act

The Social Security 2100 Act (H.R. 4583) would not entirely scrap the cap, but is a strong step in the right direction. This legislation proposes increases in benefits across the board and improved cost-of-living adjustments, a boost in benefits for low-income seniors and widows/widowers, caregiver credits, and a host of other improvements.

That’s all paid for by applying Social Security taxes to earnings above $400,000 (with those extra earnings counted toward benefits at a reduced rate), and by adding an additional 12.4% tax on investment income only for taxpayers making over $400,000.

The Chief Actuary for Social Security estimates that under the Social Security 2100 Act, the program could pay scheduled benefits in full and on time for an additional 32 years – though it should be noted that 12 of the 16 proposed benefit expansions are slated to last 10 years, then revert to current-level benefits.

Where your member of Congress stands — and what you can do

The Social Security 2100 Act is co-sponsored by 182 Democrats in Congress – though notably, not one of Washington’s members Congress. Rep. Marie Gluesenkamp Perez seems to have her sights fixed on cutting Social Security, instead. Here’s how Washington’s delegation stacks up:

Co-sponsors:

- Rep. Suzan DelBene (Democrat, District 1) | Contact

- Rep. Rick Larson (Democrat, District 2) | Contact

- Rep. Kilmer (Democrat, District 6) | Contact

- Rep. Pramila Jayapal (Democrat, District 7) | Contact

- Rep. Adam Smith (Democrat, District 9): co-sponsor | Contact

- Rep. Marilyn Strickland (Democrat, District 10): co-sponsor | Contact

Non-sponsors:

- Rep. Marie Gluesenkamp Perez (Democrat, District 3) | Contact

- Rep. Dan Newhouse (Republican, District 4) | Contact

- Rep. Cathy McMorris Rodgers (Republican, District 5) | Contact

- Rep. Kim Schrier (Democrat, District 8)* | Contact

If you’d like thank your member of Congress (find out who that is here) – or encourage them to take a different position – click their contact link and send them a note!

Note: Rep. Schrier was a co-sponsor of a previous version of Social Security 2100 Act in 2020.

More To Read

February 27, 2024

Which Washington Member of Congress is Going After Social Security?

A new proposal has Social Security and Medicare in the crosshairs. Here’s what you can do.

February 27, 2024

Hey Congress: “Scrap the Cap” to strengthen social security for future generations

It's time for everyone to pay the same Social Security tax rate — on all of their income

January 22, 2024

“Washington Saves” legislation won’t solve our retirement security crisis. Lawmakers should pass it anyway.

The details of this auto IRA policy matter.