The United States is built on the idea that everyone gets a fair shake. In practice, though, we know that’s not the case. Children who are born into poverty or who belong to marginalized identity groups face unique and difficult challenges from the moment they’re born. An innovative policy idea, though, presents a way to help even the playing field.

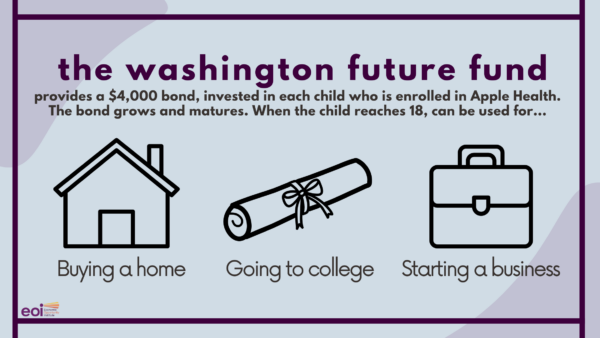

The program is called the Washington Future Fund (HB 1861 and SB 5752). Under this policy, Washington would invest $4,000 for every baby enrolled in Apple Health before their first birthday. The state makes these funds available to enrollees when they turn 18. In Washington, a baby bond program would uplift the economic security of the nearly 40,000 babies born into lower-income families.

At that time, they are able to access the matured funds. Enrollees are able to choose how to use the money; funds can be used to help pay for post-secondary education, a down-payment on a home, or seed money for a small business.

Why baby bonds?

According to economist Dr. Darrick Hamilton, the architect of baby bonds, “the fundamental point is providing people with capital at a key point in their life, so they can get into an asset that will passively appreciate over their lifetime.” By starting children off with a nest egg, the State can circumvent some of the inequity that many children are born into.

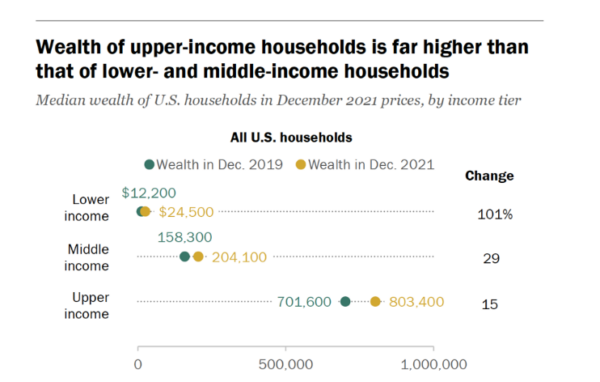

But to fully understand how baby bonds would narrow the wealth gap, we have to first understand the difference between wealth and income.

Income is revenue that you actively receive. You earn income during specific intervals or periods, like a wage or salary. You may also receive income from investments or benefits, like disability, retirement, or Social Security payments.

Wealth, on the other hand, refers to the value of assets you possess. This includes a house, stocks and bonds, and retirement accounts. These assets, often used as a safety net for the future, can be passed down from one generation to the next. There is ample research showing that access to this kind of inheritance has a significant impact on long-term economic security.

Income is a significant driver of wealth – but it’s not a guarantee of wealth. Even with a generous salary, our economic structure makes wealth-building next to impossible. If a person has amassed debt, has a medical condition, or is otherwise spending heavily, they can’t also save and acquire assets, like property. And taking on debt is not a guarantee of wealth, either.

Inequality in Wealth and Income

Often, wealth-building activities lead to more debt, especially for people from lower-income families or backgrounds. Student loans, startup money for a business, and even buying a house can trap people without means.

This is a class issue, but it is also a race issue. Families of Color simply have a more difficult time amassing wealth, even when all other components are equal.

According to the Pew Research Center, a household’s wealth greatly depends on both income and race. Even in households with people who are working, wealth gaps between White Americans and Black and Latino Americans persist. And during hard times, like the COVID-19 pandemic, it’s BIPOC families that lose out.

Nationally, the median white household has more wealth than 80% of Black households. The Washington Future Fund Committee report to the legislature cited that in Washington white households have more wealth than households of Color, particularly Black and Latino households.

How does the Washington Future Fund work?

This is a frequently asked question. How does the program work and who administers it?

The answer is fairly simple. A baby bonds program like the Washington Future Fund is established and guaranteed by the state. It acts kind of like a trust fund – a tried and true tool that wealthy families have used to invest in their children’s future for decades. Importantly, the Washington Future Fund focuses on the source of poverty and inequity in our economy.

The racial wealth gap is the result of centuries of racist policies and practices. These choices have systematically excluded Black, Indigenous, and People of Color from power, both political and economic. By using Apple Health – a social service that’s already means-tested – as a key indicator for need – state administrators can be sure that the people receiving the bonds would be those who need it most. As we see more people struggling economically, we’re able to also see where gaps in equity are widening.

Do we really need baby bonds?

In a word, yes. America’s countless oppressive, racist laws have created a system that is fundamentally unequal. It’s a system that has put wealth-building fully out of reach for many Americans.

In addition to the legacy of enslavement and subjugation in the American South, policies like the Homestead Act of 1862 and the National Labor Relations Act of 1935 continue to have a ripple effect.

There are so many examples of the ways that the racial equity gap was carved into our national economy. The GI Bill, for example, helped post-WWII veterans succeed after the war. The policy made low-interest mortgages available and provided funds to cover tuition – though it actively excluded Black veterans from certain neighborhoods. Here in Washington, banks practiced redlining well into the 1960s and 70s. Meanwhile, skilled jobs were generally filled by white workers.

And of course, there are more modern examples, as well; Washington’s farm workers received the right to earn overtime pay in 2021.

In light of these examples and many more, it’s easy to see the myriad ways that the United States has put wealth-building out of reach of People of Color.

At the same time, without these barriers, their white peers have been able to amass wealth, lapping their Black and Brown peers.

This is precisely why investments like baby bonds are particularly important for BIPOC communities. Wealth begets wealth.

Can we get baby bonds passed in Washington?

Baby bond legislation is gaining momentum across the country. Connecticut was the first state to pass similar legislation, followed by Washington, D.C. Massachusetts set up a baby bonds taskforce and Iowa, New Jersey, New York, and Wisconsin.

EOI has worked alongside numerous partner organizations and lawmakers to get the Washington Future Fund passed. We’ve had strong allies in this fight; since 2022, the Washington State Treasurer, Mike Pellicciotti, has advocated strongly for a baby bond program.

The bills have previously made it through the policy committees in both chambers of Washington’s state legislature. Ultimately, though, they have been unable to advance, largely due to funding concerns.

However, the House of Representatives has appropriated funds to study Washington’s wealth inequities and the impact the Washington Future Fund will could have on Washington families. This study could help pave the way for real movement.

If we’re serious about helping Washington residents thrive, regardless of circumstance, we need our elected officials to get serious about passing this policy next session.

Now is the time

Baby bonds are not the sole answer. On their own, they can’t eliminate wealth gaps. But as a part of a larger, comprehensive suite of progressive policies that actively work to undo centuries of oppression, they’re certainly a good step to begin uplifting those who have been left behind for so long.

Our state legislature should invest in low-income families the same way that the wealthy have been able to do for their own. An investment now could lift thousands of people out of poverty in the future.

More To Read

January 6, 2025

Initiative Measure 1 offers proven policies to fix Burien’s flawed minimum wage law

The city's current minimum wage ordinance gives with one hand while taking back with the other — but Initiative Measure 1 would fix that

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 6, 2024

Tax loopholes for big tech are costing Washington families

Subsidies for big corporations in our tax code come at a cost for college students and their families