It’s a feature of nearly every college graduation: that moment when the speaker calls the graduates to stand and acknowledge their parents with a round of applause. It’s a poignant moment at any ceremony, but even more so today as parents are footing more of the bill to see their children succeed.

It’s a feature of nearly every college graduation: that moment when the speaker calls the graduates to stand and acknowledge their parents with a round of applause. It’s a poignant moment at any ceremony, but even more so today as parents are footing more of the bill to see their children succeed.

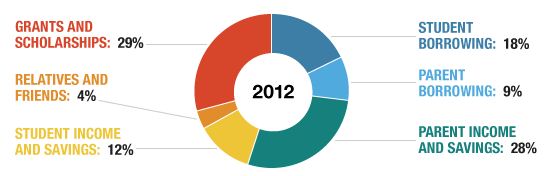

As college tuition skyrockets and state and federal aid recedes, the impact on students is well documented, but the effect on parents and families – though less publicized – is equally severe.

Tuition hikes are hitting middle class parents at middle age, forcing many to choose between saving for retirement and financing their child’s education. Parents Scott and Kelley Hawkins, profiled by NPR, exemplify the crunch. As they prepare for their two daughters to start college and continue to care for Kelley’s 87-year old grandmother, money is tight. “It’s very hard because college is very, very expensive,” Kelley Hawkins explains in the story. “But you just make it work.”

For parents hoping to improve their lot by putting themselves through college, the outlook is equally grim. Older students are less likely to have financial assistance from family members, and more likely to take out student loans and dropout of school – making single parents one of the groups most affected by student debt.

Meanwhile, families without financial means turn to risky private loans, a double edged sword for students and parents alike. High interest rates, rapid repayment schedules, and no debt discharge leads to tragic stories like the one of Francisco Reynoso, who is hounded by debt collectors while still grieving over the death of his son.

“As a father, you’ll do anything for your child,” said Reynoso.

But getting a good education didn’t always include massive debt. Back in 1980, tuition at the University of Washington was a manageable $1,912 in inflation-adjusted dollars. Today, tuition and fees have increased by more than 600% to $12,385, while the actual cost of educating a student has actually gone down by around $400 over the past 20 years.

This isn’t accounting sleight of hand; it’s what a systematic disinvestment of public education looks like. According to UW board of regents members Kristianne Blake and Craig Cole, “Twenty years ago, the state government paid 80 percent of the cost of a student’s education and a student paid 20 percent. Today, the state pays 30 percent of the cost, and the student pays 70 percent.”

It doesn’t have to be this way. To secure our children’s educational future and ensure their educational success – without financial hardship for parents and families – we should reaffirm our state’s commitment to higher education by restoring funding that has been gutted over the past decades, and exploring innovative ways of paying for college that could eliminate the need for loans altogether.

By EOI Intern Ashwin Warrior

More To Read

September 24, 2024

Oregon and Washington: Different Tax Codes and Very Different Ballot Fights about Taxes this November

Structural differences in Oregon and Washington’s tax codes create the backdrop for very different conversations about taxes and fairness this fall

September 10, 2024

Big Corporations Merge. Patients Pay The Bill

An old story with predictable results.

September 6, 2024

Tax Loopholes for Big Tech Are Costing Washington Families

Subsidies for big corporations in our tax code come at a cost for college students and their families