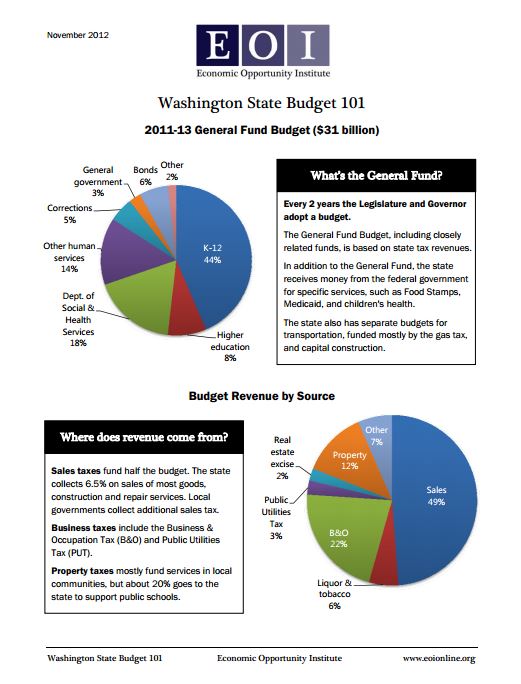

Every 2 years the legislature and Governor adopt a budget.

The General Fund Budget is based on state tax revenues.

In addition to the General Fund, the state receives money from the federal government for specific services, such as Food Stamps, Medicaid, and children’s health.

The state also has separate budgets for transportation, funded by gas tax, and capital construction.

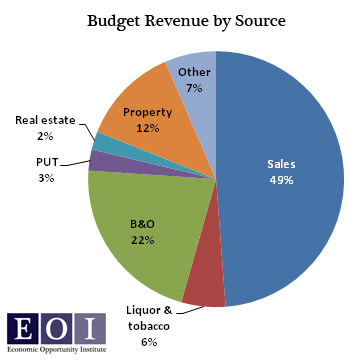

Where does revenue come from?

Sales tax funds half the budget. The state collects 6.2% on sales of most goods, construction and repair services. Local governments collect additional sales tax.

Businesses taxes include the Business & Occupation (B&O) and Public Utilities Tax (PUT).

Property taxes mostly fund services in local communities, but about 20% goes to the state to support public schools.

More To Read

March 24, 2025

Remembering former Washington State House Speaker Frank Chopp

Rep. Chopp was Washington state’s longest-serving Speaker of the House

February 11, 2025

The rising cost of health care is unsustainable and out of control

We have solutions that put people over profits

January 29, 2025

Who is left out of the Paid Family and Medical Leave Act?

Strengthening job protections gives all workers time they need to care for themselves and their families